The Internet of Things (IoT) is rapidly revolutionizing how enterprise organizations work, and technology budgets are increasingly reflecting the need for IoT investment. At least $3.1 billion of IT consulting services and $11.2 billion of systems integration services will be consumed building and implementing IoT solutions worldwide in the next three years. Organizations recognize that today’s faster pace of business and their desire for digitally enhanced business transformation means a bigger technology budget.

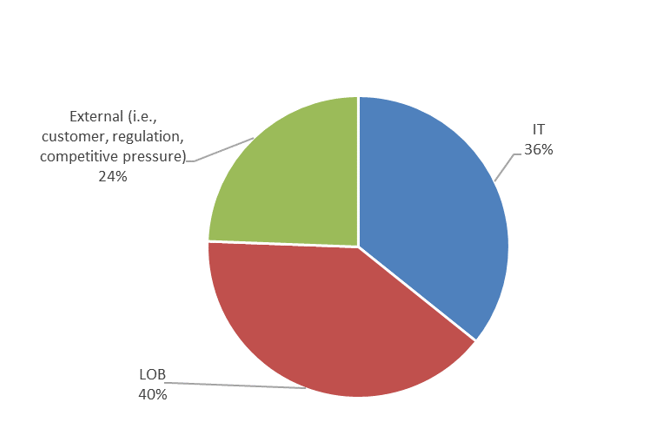

But who within the organization is making the call for IoT investment specifically? According to a recent IDC Survey Spotlight, while there are multiple advocates within an enterprise, the lines of business (LOBs) are the biggest advocates for IoT spend, accounting for 40% of budget decision makers. IT follows closely behind at 36%, and surprisingly, external forces such as customers or competitive pressures factor in IoT investment decisions at 24%.

Stakeholders from LOBs and IT are both driving IoT investment, but don’t underestimate the influence of external factors – particularly regulatory requirements in certain industries and competitive pressures to differentiate from other participants in the industry. These can be major factors and accelerators when it comes to making IoT investment decisions.

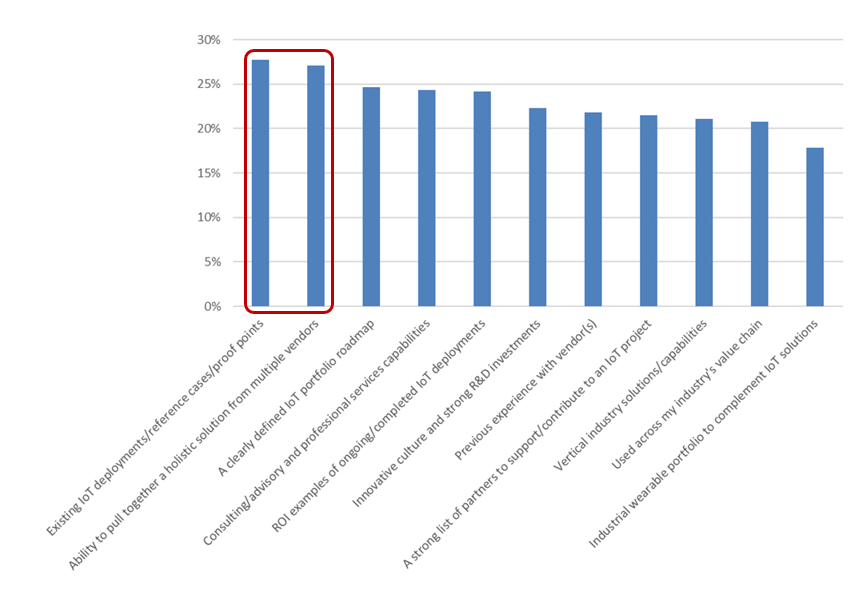

IDC isn’t just interested in who is making investment decisions; the Spotlight also asked respondents to name their top three selection criteria when evaluating IoT vendors and suppliers. While there were myriad responses, a select few bubbled to the top.

Namely, existing IoT deployments, cases or proof points; an ability to shape a holistic IoT solution from multiple vendors; and a clearly defined IoT portfolio roadmap are all major selection criteria in IoT investment.

Namely, existing IoT deployments, cases or proof points; an ability to shape a holistic IoT solution from multiple vendors; and a clearly defined IoT portfolio roadmap are all major selection criteria in IoT investment.

It’s important to note that while, at this point in the IoT market, vendors have fairly robust roadmaps for their IoT offerings, that roadmaps alone aren’t enough to move the needle for enterprise buyers. A clearly articulated vision of how an IoT product/solution can help an organization meet its objectives is what weighs heavily in the decision-making process.

So why is this so important? For IoT vendors and solution providers, it’s important to understand the primary stakeholders and understand what criteria they are looking to use in evaluating IoT solutions. At a macro level, the most important criteria organizations use to judge a vendor is proof points of existing customer projects, but remember that this is not necessarily the top criteria for all industries.

For example, in government, utilities and financial services – including insurance – the top criteria is the vendor’s ability to pull together a holistic IoT solution from multiple vendors. Knowing who is leading the decision-making process and what is important to them and to the organization allows you to better prepare your solution and sales process to attract and delight customers.

IoT investment will only continue to grow over the next three years; solution providers need to develop greater insight into who is leading purchasing discussions within organizations and a greater understanding of their vendor criteria in order to compete.

What other services enable IoT investments in organizations? Learn more with IDC’s Market Note, “4 Services that Enable IoT for Organizations.“