There are two primary ways to buy or trade data in the Data as a Service (DaaS) market – direct sales from a data provider to end users, or via a data marketplace. While large, established information services businesses continue to make direct sales to their customers, many are also participating in data marketplaces. For smaller and emerging providers of DaaS, the rise in data marketplaces has made it simpler for them to package and sell their offerings, and for potential customers to find them. Marketplaces simplify the searching process, providing a variety of sources and types of data, along with a ready group of potential buyers.

Why Should You Consider Data Marketplaces?

The first and most obvious advantage of a marketplace is that it can bring together a large number of potential buyers and sellers, reducing marketing costs for sellers and searching costs for buyers. To be successful as a marketplace, each must have a variety of DaaS to offer.

While it is an advantage for a marketplace to have a large number of sellers and a large number of potential buyers, the marketplace can also provide value by qualifying the buyers and sellers on the platform. According to IDC research, the most important factor in selecting a DaaS vendor is trust, and marketplaces are taking steps to increase the trust level when they are involved in transactions.

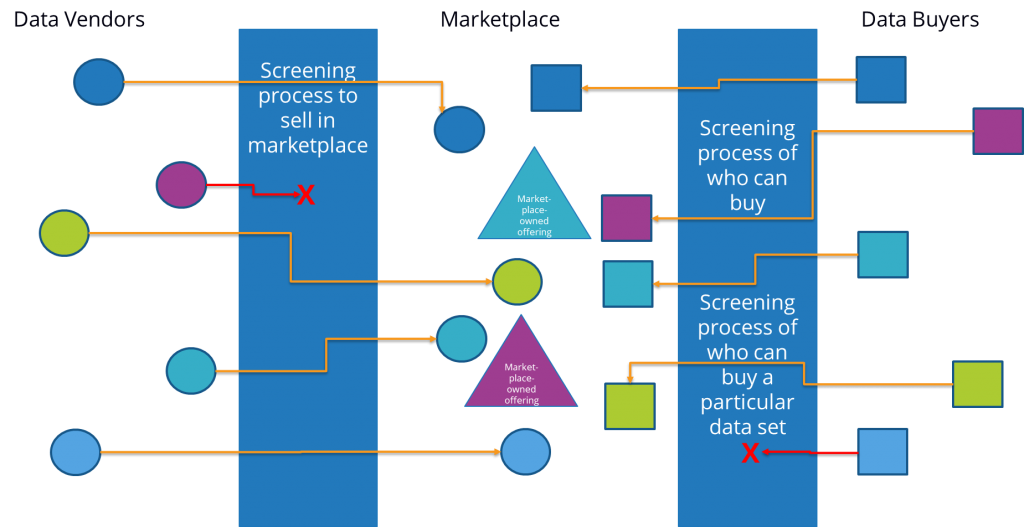

Data Marketplace Screening Processes, 2018

On the left side, there are a large number of potential vendors who would like to participate in the marketplace. Most of the marketplaces limit the sellers who can list on the platform. Basic screening in any data marketplace includes the data vendor verifying that it has the right to sell or license that data, that they have obtained the data legally, and at least a limited financial check of the organization so that the buyers can be assured that the data vendor will make an initial delivery of data.

On the right side, there are also a large number of potential buyers who would like to participate in the marketplace. Many marketplaces take the approach that they are merely facilitating a transaction, allow anyone to search the marketplace, and put the onus to vet buyers on the data vendor. There is a middle ground, where the marketplace does a short review to qualify buyers and then either the vendor or the marketplace do additional reviews before entering a contract. In a more conservative operating model, companies not only screen the potential buyers, but also limit the datasets that they can see or purchase in the marketplace based on criteria from the individual data vendors.

What Else Can a Data Marketplace do for You?

Marketplaces serve a varied set of buyers and sellers – with variance in their technical abilities with software and analytics, their geographies and industries, their use cases for DaaS, and in their overall sophistication in the DaaS market. So, in addition to performing as the physical market where parties meet, the marketplaces offer a variety of services which help facilitate DaaS. Table 1 is a brief overview of the types of services that are offered, by phase of participating in the marketplace. The first column includes services which help data sellers to get their data ready for sale and the services in the middle column support promotion and product development within a specific marketplace. The last column represents a wide variety of tools and services that may be available to make the data transactions happen and monitor their success.

| Data Marketplace Services | ||

| Acquisition & Preparation | Promotion & Productivity | Delivery & Monitoring |

| Ingestion

Evaluation Cleansing Structuring Aggregation Anonymization Derived data creation

|

Marketing

Search and match Product development |

Data connectors

APIs SLAs Contracting Dispute resolution Customer support Permissions Usage tracking Product ratings |

| Source: IDC, 2018 | ||

The format of data marketplaces vary on several dimensions, including types of data available, industry or business function focus, data domain, services provided to buyers and sellers, and restrictions on where the data can be used. IDC refers to the levels of restriction as ‘Closed Marketplaces’ and ‘Open Marketplaces.’ In a closed marketplace, the data can only be used in a particular software solution, and in an open marketplace, the data can be used more broadly by the data acquirer.

In closed marketplaces, revenue models vary from those that are done at cost (or even a small loss) to promote the stickiness of the software/service ecosystem, to those that earn a modest commission or listing fee from the data vendor. Business models for open marketplaces are quite different, since the open marketplace providers need to generate revenue from the marketplace functionality. Though the prices for data access tend to be similar to direct contracts and across open marketplaces, the commissions/fees run from about 5% to 25% or more. There is also group of open, cryptocurrency-based data marketplaces which have a different business model, funded through Initial Coin Offerings (ICOs).

In addition to the formal 3rd party digital marketplaces, there are other marketplace structures including organizations that facilitate 2nd party data sharing, face-to-face marketplaces, API marketplaces, markets where individuals could potentially license their personal data and platforms that create marketplace-style offerings within a company or family of companies.

Are Data Marketplaces Going to Last?

DaaS is a growing area, and many new entrants in the DaaS space are taking advantage of marketplaces because they need these services to make their offerings viable. IDC projects growth in DaaS; much of it fueled by new entrants, and believes that in the short term, marketplaces will continue to offer a high level of service and may even increase their offerings. For many marketplaces, this will be through partners that offer consulting or technical services To be an ongoing, profitable part of the market landscape, the marketplaces need to clearly understand the market gap they address, what data, service and other technology vendors can support this vision; and how to create a long-term financially viable business model.

IDC sees a much larger number of companies seeking to monetize their data, and the majority will turn to marketplaces to make this a commercial reality. The marketplaces themselves are seeing growing interest in participation. For example, Dawex had approximately 100 data vendors 18 months ago – and can boast of more than 3600 today.

The term ‘marketplace’ is attractive for marketing DaaS, and IDC has noted that there are some vendors who are using that term to refer to the fact that they offer more than one DaaS. There are also some other software solutions which include data, or have data options which are owned by the provider. In their current iterations, these are not marketplaces, as defined by IDC, because they do not provide access to a range of data sources. However, it seems likely that they will expand the available sources as marketplace gain traction as a DaaS distribution channel.

P.S. You can’t actually meet me at any data marketplace, but you can contact me at lschneider@idc.com

Want to learn more about the future of the global datacenter and DaaS? Listen in to IDC’s Worldwide Datacenter 2018 Predictions FutureScape.