There is an often-quoted economic theory that describes the balance that occurs when competitors in a market of a fixed size win or lose share depending on the success or failure of the other. The “zero sum game” (as it is known) has been cited so often since the financial crisis of the late 2000’s slowed global growth, that its continued use is becoming something of a cliché. Having said that, some industries in deregulated Western markets – such as transportation, manufacturing and consumer goods – have always been intensely competitive, and any additional price pressure has resulted in periods of contraction followed by ecosystem stabilization. For other industries – such as IT Services – the assumption by many has been that this sector has continued to expand along the general computing model, ala Moore’s Law. But is that the case?

IT Services for Cloud

The reality is that the IT services sector has not been without its crisis either. A downturn in demand for consulting, training and parts of the outsourcing business affected the fortunes of leading systems integrators as well as the services divisions of global IT vendors. Stagnating growth resulted for a number of those offering traditional application management, with many enterprises looking at nearshoring operations or bringing some aspects of IT management back in-house.

It would be easy to say that all this changed when cloud came along, but of course that would be equally cliché. The arrival of Amazon Web Services (AWS) in 2006 legitimized the consumption of IT services using new methods: utilizing multi-tenant servers on a vast scale, using a retail model to “pay as you go”, blitzing the concept of infrastructure ownership for many enterprise firms.

The belief was (and still is for many) that AWS would eventually squeeze out all other forms of infrastructure cloud providers. In fact, the opposite has happened: AWS’ success stimulated the market and, for cloud service providers today, the pie is getting bigger and there is an abundance of demand for all forms of delivery – public, private, and hosted on- and off-prem. “Zero sum” does not apply as a generalization.

Why Cloud is “Positive Sum”

IDC’s 1Q 2018 Service Provider Pulse found that there are the five key reasons why cloud is a “positive sum” for service providers:

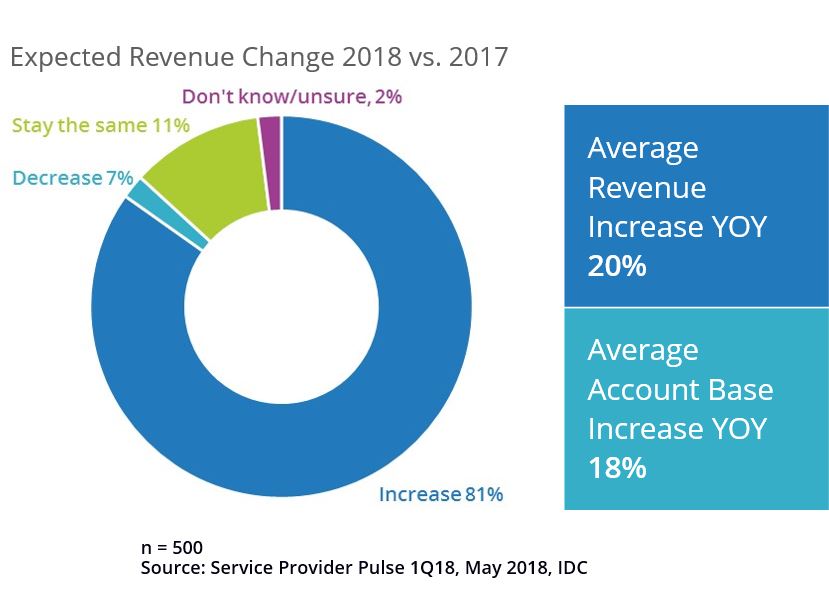

- The cloud services pie is getting bigger: not only are providers highly optimistic about the future of their businesses, but they also expect to grow on average 19% during 2018. Incremental revenue will come from signing new clients, but also from selling new services to existing clients.

- All delivery methods are increasing: While 56% of providers surveyed use public cloud to deliver services to their clients, almost as many also use private cloud, as well as managed hosting, colocation and other combinations. One method is not being substituted directly for another.

- Providers are investing in cloud services: Not only in datacentre infrastructure to support service provision, but also in staff – including hiring and training to bridge skills gaps – as well as marketing and operational capabilities to support this

- Partner ecosystems for cloud are maturing: The top global cloud infrastructure providers – including AWS, Microsoft, Google, IBM, HPE and others – all offer partner programs that facilitate a diverse range of service providers, increasing sell-with opportunities in addition to more established sell-through/resell business.

- Service attach rates are increasing: Around one-third of cloud infrastructure, application and managed services are increasingly being bundled together, while professional services for cloud (assessment, migration, integration etc.) represent at least 25% of all cloud revenue for providers.

Recommendations for Service Providers

If we accept that cloud service provision is a positive sum game, then there are more opportunities in a wider range of service types, and in a broad range of delivery methods. For cloud service providers, IDC recommends that companies should:

- Choose the delivery method based on application workload need: Needs change as workload usage changes. A recent IDC study showed that where interoperability between data and applications exists, private cloud is typically the on-ramp to public cloud interoperability. At the same time, public cloud may no longer be appropriate for some workloads and there is a need to repatriate them to e.g. private cloud.

- Ignore vendor insistence that one cloud is enough: we live in a multi-cloud world where your customers (unless they are start-up firms) have as much a need for application and workload integration, co-existence and transition planning as for pure migration.

- Shop around: being tied to one or two technologies / vendors has historically given certain exclusivity advantages but this is much less the case today. At the same time, offering best-of-breed technology may only be possible by a few firms, and most will benefit from a balance between being vendor-agnostic and aligning purely to one or two.

Recommendations for Technology Vendors

Rather than carrying on with current approaches, in an abundant market, the role of the technology vendor needs to also change. It may seem paradoxical that a growing market increases competition between vendors, but when it comes to cloud service provision, it appears that this is the case. The preference for multi-cloud and multi-vendor seen in the 1Q18 IDC Service Provider Pulse points to strategic opportunities that IDC believes technology vendors should consider:

- Embrace multi-vendor partnering models: Service providers are not just looking to sell product X or product Y with an individual offering. They are looking to combine X plus Y with service Z to provide a specific solution. Openness to multi-vendor partnering potentially increases coopetition but benefits long-term partnerships with providers.

- Revise go-to-market models to include “sell-with”: Service providers are increasingly looking to spend more on solution partnering to reach their business goals. While they will also buy directly from vendors, the IDC Service Provider Pulse has found that selling their own solution in conjunction with a vendor’s product has been the highest-rated sales activity by providers during 2018.

- Foster service provider technology development: Over 60% of service providers surveyed plan to increase their investment in software, device and/or IP development. Vendors that provider platforms, tools and programs that encourage and enable this will benefit from partner loyalty and deeper integration with their own offerings.

Learn more about what organizations need from their cloud service providers – watch the quarterly summary of IDC’s Service Provider Pulse on-demand.

Interested in seeing more of IDC’s cloud primary research? Explore the turnkey solution that offers a complete understanding of cloud products and services buyers across the entire cloud ecosystem.