2024-25 will be yet another stellar year for India and Indian financial institutions. There may be some ‘over-crowding’ of state-owned banks, private sector banks, NBFI’s and new Digital / Payments only banks – but this is at least five years away. Right now is grow, grow, grow for India Inc. Augmented by the government’s capital expenditure and strong domestic consumption, India’s GDP growth forecast for this financial year stands at a whopping 8%. Furthermore, the global socio-political turmoil is benefiting India in the form of increased global trade flow and foreign direct investments perspective.

The banking sector had a super 2023 and is forecasting an even better 2024. Capital to risk-weighted assets ratio and the common equity tier 1 (CET1) ratio stood at 16.8% and 13.7% respectively, and non-performing assets (GNPA) ratio fell to multi-year lows of 3.2%. The government, in the Feb 2024 budget, announced that it will not undertake any major bank privatization over the next fiscal year. Technology service and solution providers saw a massive up-take in IT spend amongst most of the Tier-1 banks and insurers in India. The Account Aggregator framework introduced by the RBI triggered a lot of this “market grab spend” too.

The India Financial Services Summit will address the pressing question; What Next? Banks in India have started addressing their Core banking systems – how will this lend to the Open API Banking architecture? Datalakes and Datawarehouse initiatives only just went live so what is expected from Graph (data technology)? Account Aggregator take up has been slower than expected, how will Indian Financial Institutions convince the consumers? Will AI disrupt the way to produced, update and refresh our application stacks? All this and more will be discussed at our action-packed, India Financial Services Summit.

The future of financial services in India holds immense promise, characterized by a blend of innovation and inclusivity. Fintech advancements are set to revolutionize the banking sector, catering specifically to the needs of the unbanked and underbanked populations. Mobile payments, digital lending, and other emerging technologies will thrive, offering greater accessibility and convenience to consumers across the country.

This transformation is further bolstered by regulatory evolution, which aims to ensure stability and consumer protection in the financial services ecosystem. Collaborations between traditional banks and fintech startups will play a pivotal role in driving efficiency and customer-centricity, ultimately fostering economic growth and prosperity.

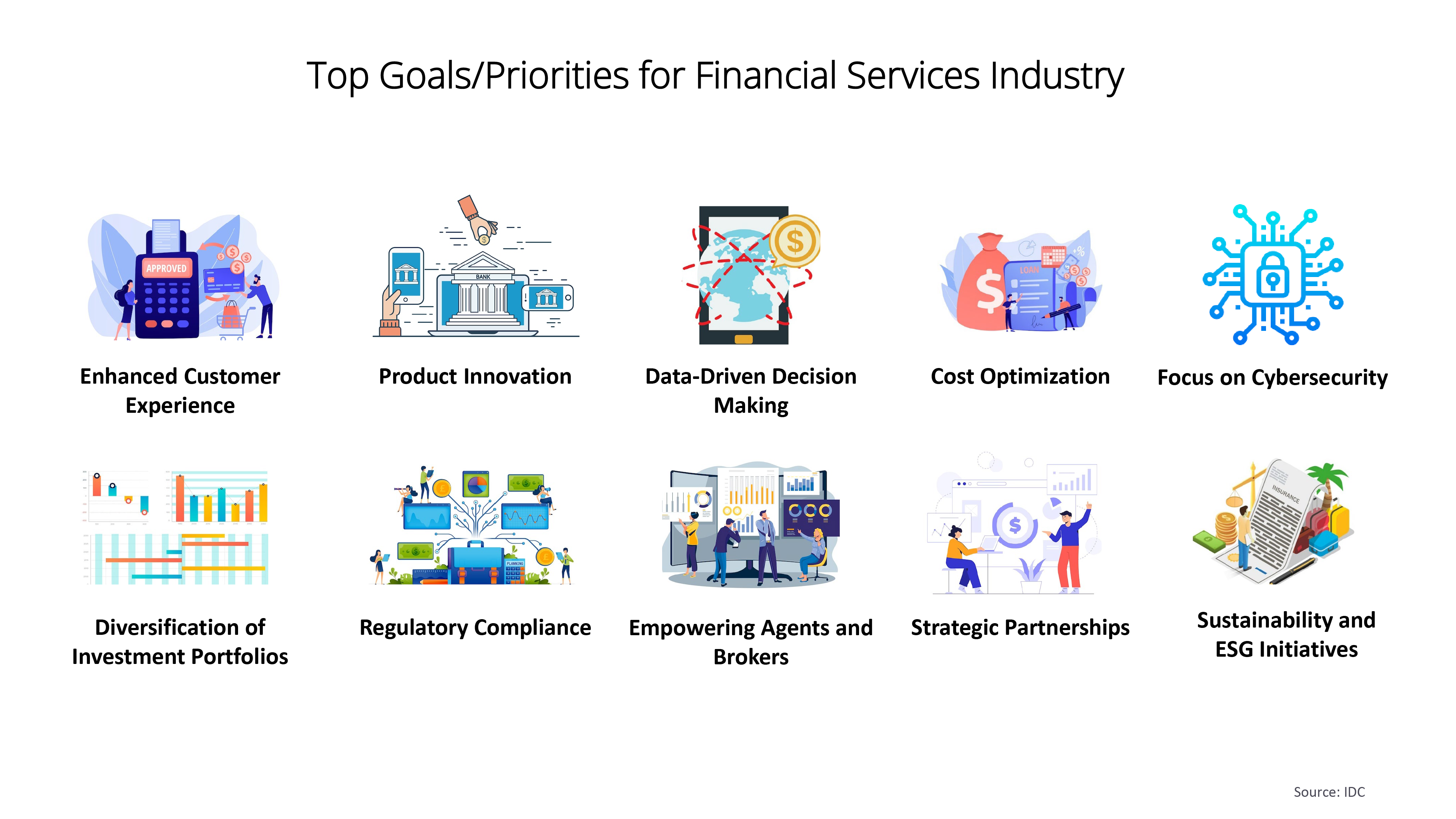

According to IDC, Indian financial institutions are projected to increase their technology spending by 11.4% this year. This emphasis on technology investment underscores priorities such as security, data transformation, legacy core modernization, and the adoption of AI/ML solutions.

India's economic resilience is evident, as recognized by global institutions like the World Bank and the IMF, projecting it as the fastest growing among major nations. As per IDC's 2023 India Digital Business Survey, the below can be considered

- India's economic dynamism is acknowledged globally, with robust projections by institutions like the IMF for sustained growth in 2024 and beyond.

- Indian enterprises are heavily investing in digital technology, with around 70% increasing their digital tech budget by 19% from 2023, totaling approximately $63 billion.

- The focus is on leveraging AI and Generative AI technologies to enhance customer satisfaction, revenue generation, and innovation, with over 75% of companies exploring or implementing Generative AI.

Furthermore, the next two years will see a strategic realignment towards digital transformation (DX), with a sharp focus on elevating customer experiences and revenue generation. CEOs are spearheading the formulation of digital strategy decisions. While 2023 observed a cautious approach to IT spending, 2024 is anticipated to witness a notable change, marked by increased budgets aimed at fortifying resilience and competitiveness through innovative technological initiatives.

The Financial Services Summit 2024 in India will offer exclusive insights from senior analysts, financial experts, industry trendsetters, and financial industry's thought leaders as they delve into the latest trends and technologies driving innovative operating principles at scale within the Indian financial landscape. With senior leaders from India's financial sector in attendance, the summit will facilitate discussions on the evolution of the Indian financial services industry and the profound positive impact of innovative digital solutions on profitability, growth, and customer experiences within the Indian market. Besides, as part of this digital transformation and in alignment with the priorities set by the Reserve Bank of India (RBI), several key initiatives are being prioritized:

- CBDC: The RBI is exploring a digital version of the Indian rupee to boost financial inclusion, lower transaction costs, and ensure secure transactions.

- Electronic Payment System: Leveraging Aadhaar, the RBI is fostering an electronic payment system for seamless, secure transactions, especially for those without traditional banking access.

- Electronic Trading Platform: The RBI prioritizes electronic trading platforms to improve market efficiency and transparency, enabling the trading of financial instruments while ensuring regulatory compliance.

These initiatives, along with broader technological advancements and regulatory support, are poised to reshape the financial services landscape in India, driving greater accessibility, efficiency, and innovation while promoting economic growth and inclusion.