Each of these challenges require technology investments. In this context, the bank must decide on what its priority investments will be. Let’s briefly review some of these bets that could be potential winners in 2025 and beyond.

Banks need to be agile in their transformation initiatives.

Agility requires a mix of technology infrastructure and a build strategy that enables fast deployment of new capabilities. The build strategy could be a platform strategy, microservices architecture enabling fast integration of external capabilities, or a mix of adopt and build. What fits best for each capability requires a fine decision that is both an art and a science.

What is needed is an infrastructure that facilitates innovation.

All of us who have struggled with the “Technology Bill of Material” understand that the legacy infrastructure setup processes are in months in an age where innovation, POC, and A/B tests are required within days. That is where cloud computing is important, and it must be in the mix. Cloud computing is also important as more and more of the enhancements require extensive data computing.

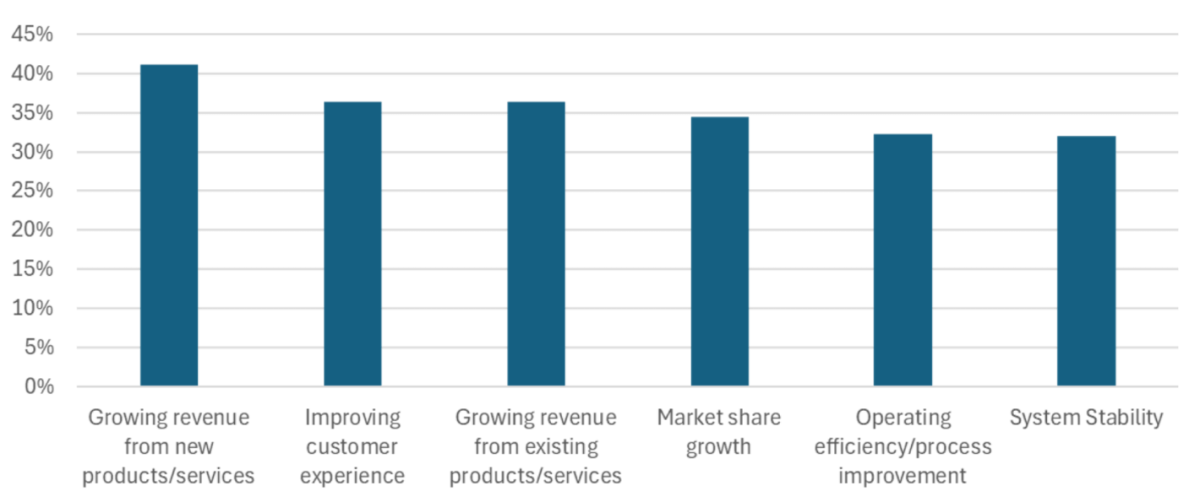

While agility helps build an architecture for fast innovation deployment, banks still need to decide on enhancements. Three factors are coming into play in today’s digital age. These are functionalities that increase revenue, automation opportunities to improve efficiency, and, finally, build trust through resiliency and avoiding financial crime.

In IDC’s survey (Jun’24), 41% of the banks stated that they require new products and services to generate revenues.