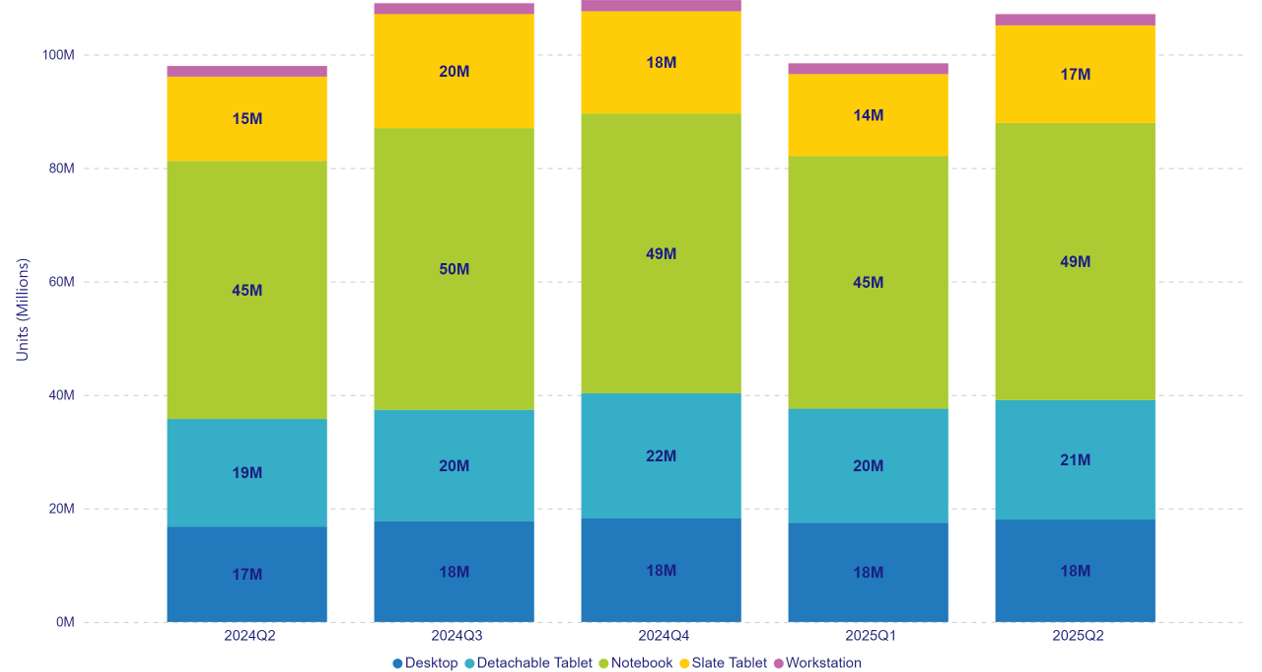

PCD Market Overview 2025Q2

PCD market posted growth of 9.3% in the second quarter of 2025 (2Q25) from the prior year, with global volumes reaching 107.1 million shipments. PC market grew by 7.3% year-over-year with shipments totaling 107.1 million units and tablet market grew by 13.1% with shipments totaling 38.3 million units. While both PC and tablet markets continue to grow, the US market is starting to feel the pinch of import tariffs.

The US PC market was expected to cool down this quarter given the inventory buildup to begin the year, but what we witnessed here highlights US PC demand slowing down in anticipation of the import tariffs looming deadline. Despite a flat US PC market, the rest of the world demonstrated an appetite for PCs, fueled by an aging installed base and by a steady transition to Windows 11.

Tablet market performance was better than expected. Growth continued from the first quarter with product refreshes, replacement cycles, active education projects and subsidies in China driving the shipment volume. Vendor pre-stocking activity in anticipation of tariffs led to better-than-expected performance in the U.S.

“We realize PC growth in such an indeterminate market seems odd, but many factors come into play supporting the momentum,” said Ryan Reith, group vice president with IDC’s Worldwide Device Trackers. “The supply side of the PC industry is doing its best to navigate the unknowns as no one wants to sit on their heels and potentially miss an opportunity, but at the same time it is very risky carrying inventory which is a possibility given the strong first half sell-in. The bigger concern is what overall demand looks like as we get late into Q3 and beyond. Price increases will likely be dispersed over time and geography depending on vendor strategy which can potentially lead to some attractive promotions as a way to clear inventory backups. Also, something that would seem odd at a time when prices are expected to rise because of tariffs.”

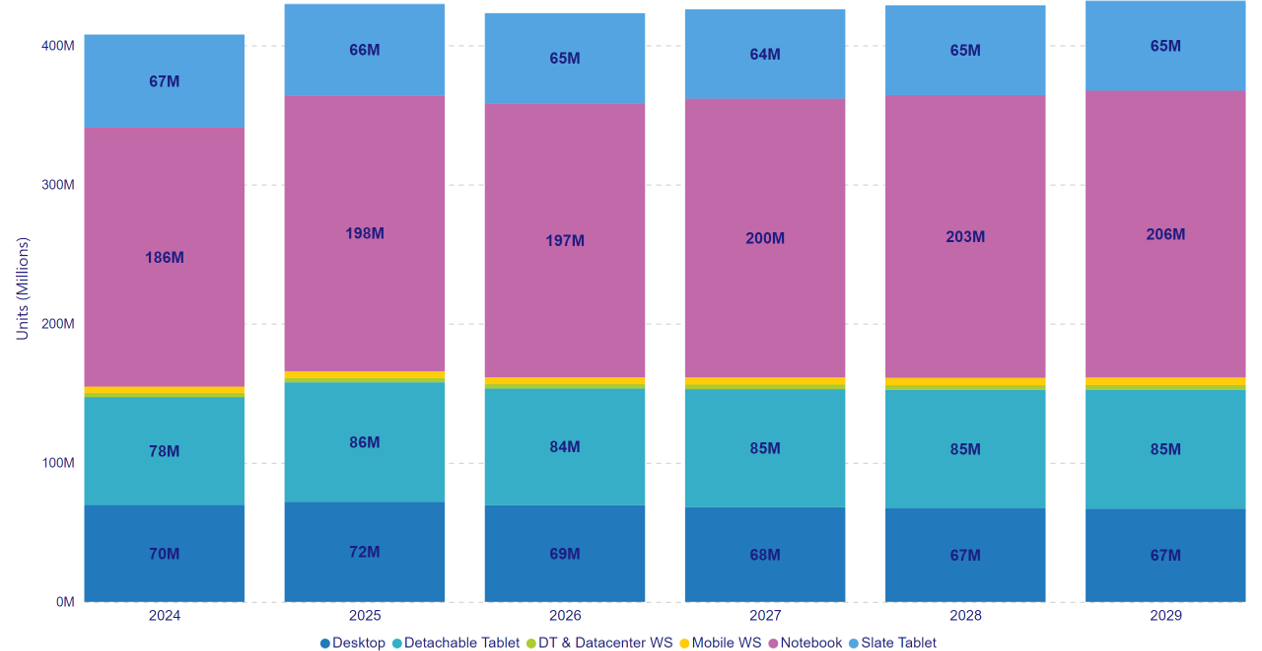

Looking ahead, the PCD market is forecasted to grow by 5% year-over-year in 2025Q3 and by 5.4% year-over-year for full year 2025 with a total of 430 million shipment units. Better than expected shipments in 2025H1, with strong performance from some PC and tablet vendors and some anticipated deals in 2025H2 will drive the market. In addition, seasonal activity is expected to further increase volumes in short term forecast.