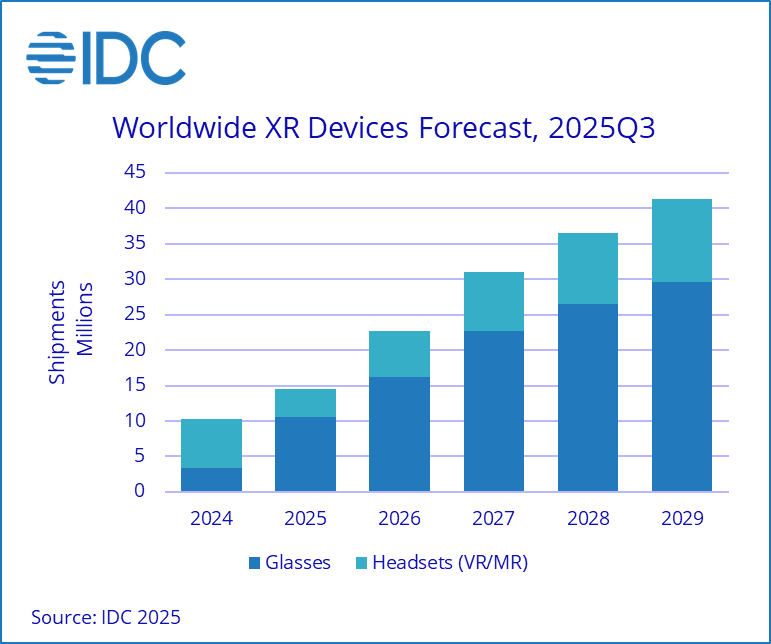

NEEDHAM, Mass., December 11, 2025 – With 2025 coming to a close, IDC forecasts global XR device shipments—including headsets and glasses—to grow 41.6% in 2025, reaching 14.5 million units, according to new data from the International Data Corporation (IDC) Worldwide Quarterly Augmented and Virtual Reality Headset Tracker and Worldwide Quarterly Wearable Device Tracker. Worldwide, the growing mainstream acceptance of XR glasses and continued enthusiasm from gamers for mixed reality and big-screen experiences have propelled the market forward.

Despite strong growth from multiple vendors and the emergence of new brands, Meta remains the dominant player, capturing 75.7% share in Q3 2025 with its combined lineup of Quest and Ray-Ban products. Xiaomi ranked second with 4.3% share, driven by the launch of its AI glasses. XREAL secured third place with 2% share and held a strong position in the premium segment (over $350) of display glasses. RayNeo, a brand well-known in Asia, claimed fourth place with 1.8% share, thanks to its value-oriented offerings. Viture rounded out the top five at 1.3% share, and is poised for growth following recent channel expansion, including entry into Best Buy retail stores.

“The XR market is undergoing a major transformation as we move away from bulky headsets toward slimmer, more accessible designs,” said Jitesh Ubrani, research manager for IDC’s Worldwide Mobile Device Trackers. “This shift means success will hinge not just on technology but on fashion and comfort. Convincing someone who doesn’t need prescription eyewear to wear glasses all day is far more challenging than getting them to wear a watch or carry a phone. Brands that fail to address design along with battery life, and app ecosystems will struggle to gain traction.”

As part of this transition, mixed and virtual reality headset shipments are expected to decline 42.8% in 2025, while the rest of the XR market grows 211.2%. MR/VR headsets are projected to rebound in 2026 with the launch of new devices, though their appeal will remain largely limited to gamers and businesses focused on design, training, and collaboration. Meanwhile, XR glasses are expected to grow at a compound annual growth rate (CAGR) of 29.3% from 2025 to 2029.

While Meta leads today, the competitive landscape is shifting. Google’s Android XR platform and its hardware partners are expected to introduce new products and raise consumer awareness, creating opportunities for brands like XREAL to challenge Meta’s dominance. However, the road ahead is not without obstacles: battery life limitations, immature app ecosystems, privacy concerns, and convincing consumers of real-world utility remain key hurdles that could slow adoption.

“What will be interesting to watch is how the different platforms evolve, gain developers, and attempt to out-innovate each other,” said Ramon T. Llamas, research director with IDC’s XR Hardware and Interactive 3D Software. “Meta has a strong start, but both Apple and Google bring expertise, applications, and an installed base of users. This could end up like what we saw in the late 2000s/early 2010s when the different smartphone platforms attempted to one-up each other. The result: faster and greater innovation and development, much to the delight of end-users.”

About IDC Trackers

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly Excel deliverables and on-line query tools.

For more information about IDC’s Worldwide Quarterly Augmented and Virtual Reality Headset Tracker, please contact Jackie Kliem at 508-988-7984 or jkliem@idc.com.

About IDC

International Data Corporation (IDC) is the premier global provider of trusted technology intelligence, advisory services, and events. With more than 1,000 analysts worldwide, IDC offers global, regional, and local expertise on technology, IT benchmarking and sourcing, and industry opportunities and trends in over 100 countries. IDC’s analysis and insights help IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. To learn more about IDC, please visit www.idc.com. Follow IDC on X at @IDC and LinkedIn. Subscribe to the IDC Blog for industry news and insights.

-###-

All product and company names may be trademarks or registered trademarks of their respective holders.