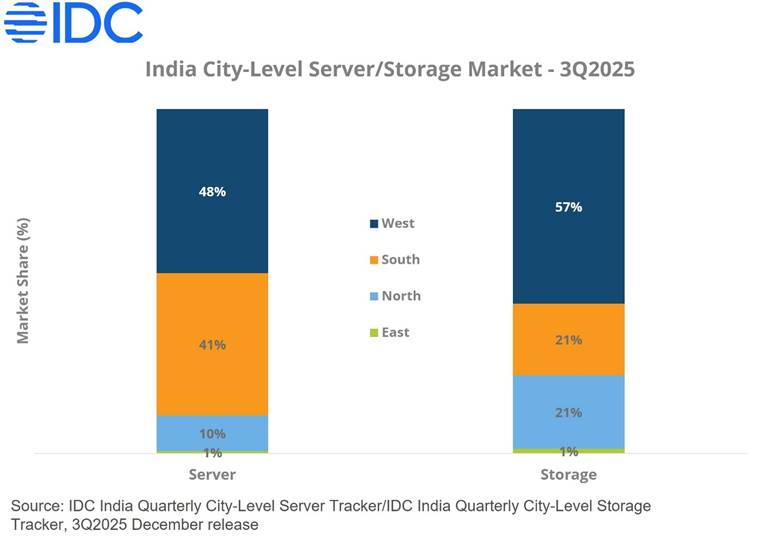

BANGALORE, January 19, 2026 – West and South India together accounted for over 89% of the country’s server demand and 77% of storage revenues in 3Q2025, driven by continued investments from hyperscalers and domestic data center providers, according to IDC’s India Quarterly City-Level Server Tracker and India Quarterly City-Level Storage Tracker. At the same time, rising adoption of cloud, AI, and edge computing is accelerating infrastructure deployments beyond major metros into Tier II and Tier III cities, signaling a shift toward more distributed, regionally deployed digital infrastructure across India.

While infrastructure demand remains concentrated in a handful of large metro markets, enterprise activity across manufacturing, BFSI, healthcare, e-commerce, media, education, and government sectors is steadily expanding into Tier II and Tier III cities. As workloads become more data-intensive and latency-sensitive, enterprises are increasingly deploying regional and edge infrastructure to support digital services closer to end users. This shift is prompting data center providers and technology vendors to reassess city-level deployment strategies and accelerate investments beyond traditional Tier I hubs.

Why Tier II and Tier III cities?

- Rising investments from manufacturing, NBFCs, healthcare, e-commerce, OTT, education, and government among Tier II/III cities is forcing edge build outs. These sectors now require regional data hosting as applications become more data-intensive hence processing must move closer to users to reduce latency and improve performance

- Both central and state governments are actively promoting data center expansion beyond Tier I cities through tax incentives, faster approvals, lower real estate costs, and dedicated data center zones. The upcoming National Data Center Policy is expected to further accelerate Tier II and III investments by offering stronger incentives and improved financing support for the growth of Enterprise Infrastructure Market

Challenges: Infrastructure Gaps and Ecosystem Readiness

- Building data centers in smaller cities comes with infrastructure gaps, including inconsistent power availability and network connectivity. The local vendor ecosystem is also still maturing, leading to longer procurement timelines, limited access to specialized expertise, and slower maintenance response cycles.

- Additionally, smaller cities face talent and market readiness challenges, with a smaller pool of skilled data center professionals and slower adoption of advanced digital technologies among local enterprises, largely due to low levels of technology awareness, inadequate exposure to modern IT architecture, and capability gaps.

“India’s Tier II and Tier III cities are emerging as the next growth frontier for enterprise infrastructure, driven by enterprise expansion, government policy, digital adoption, and cost–quality advantages over metros. However, sustaining long-term growth will require technology providers to investment in customer education, workforce training, and building robust security/compliance capabilities,” said Dileep Nadimpalli, senior research manager, IDC Asia Pacific.

IDC’s India Quarterly City-Level Server/Storage Trackers provides an in-depth analysis of the server and storage markets across India’s 26 most vibrant cities. This offering delivers deep, actionable insights at the regional and city levels, while highlighting the key industry verticals driving infrastructure spending in each of the cities. It enables stakeholders to clearly identify demand hotspots, prioritize high-growth cities, and accordingly align go-to-market strategies.

For more information about IDC’s India Quarterly City-Level Server/Storage Trackers, please contact Dileep Nadimpalli at +91 9986008999 and dnadimpalli@idc.com.

Click here to learn about IDC’s full suite of data products and how you can leverage them to grow your business.

-Ends-

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,300 analysts worldwide, IDC offers global, regional, and local expertise on technology, IT benchmarking and sourcing, and industry opportunities and trends in over 110 countries. IDC’s analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is a wholly owned subsidiary of International Data Group (IDG), the world’s leading tech media, data, and marketing services company. To learn more about IDC, please visit www.idc.com. Follow IDC on Twitter at @IDC and LinkedIn. Subscribe to the IDC Blog for industry news and insights.