In late 2025, the global semiconductor ecosystem is experiencing an unprecedented memory chip shortage with knock-on effects for the device manufacturers and end users that could persist well into 2027. DRAM prices have surged significantly as demand from AI data centers continues to outstrip supply, creating a supply/demand imbalance.

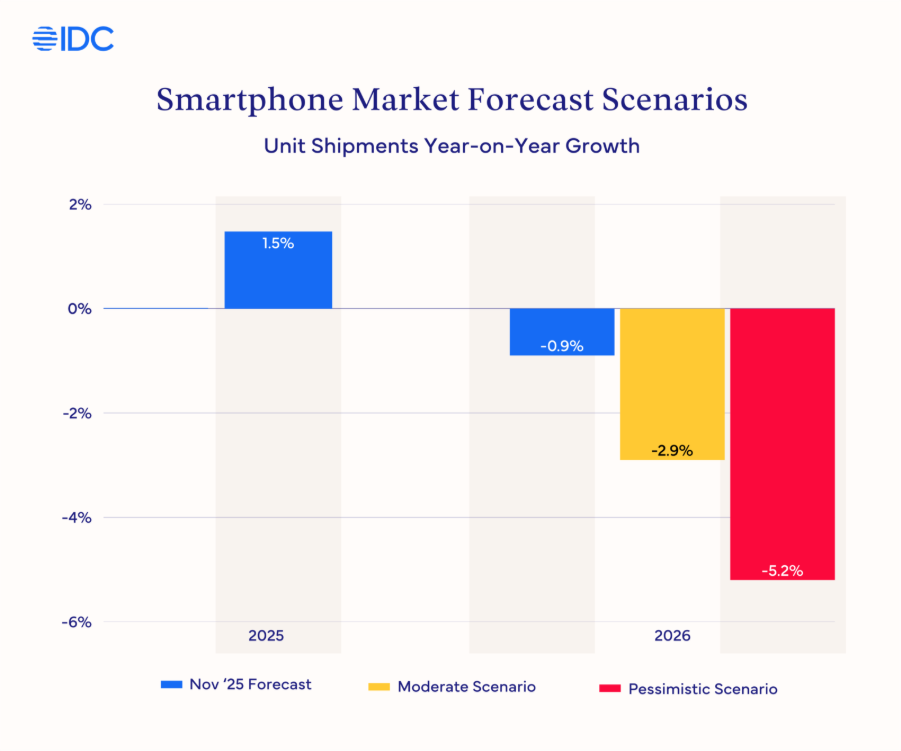

IDC was monitoring the memory situation as we prepared our November device forecasts, and we factored them into the update. The situation, however, has become more acute since publishing, and we feel it’s important we address the situation. Although we are maintaining our official forecasts as the situation is still evolving, we will offer here two downside risk scenarios that may play out in two critical markets: Smartphones and Personal Computers.

What’s causing the shortage? The memory market is at an unprecedented inflexion point, with demand materially outpacing supply. For an industry that has long been characterized by boom-and-bust cycles, this time is different. The rapid expansion of AI infrastructure and workloads is exerting significant pressure on the memory ecosystem. These AI workloads require large amounts of memory, and the shortage, in part, is driven by a reallocation of manufacturing capacity away from consumer electronics toward high-margin memory solutions to support AI. Instead of expanding conventional DRAM and NAND used in smartphones, PCs, and other consumer electronics, major memory makers have shifted production toward memory used in AI data centers, such as high-bandwidth (HBM) and high-capacity DDR5. This has restricted the supply of general-purpose memory modules and driven up prices across the board.

AI servers and enterprise environments require far more memory per system than consumer devices, so the AI build-out is pulling a disproportionate share of global capacity and creating shortages, as suppliers prioritize orders from hyperscalers and OEMs building AI servers. That dynamic has left less DRAM available for consumer devices, exacerbating price pressure in a tight market.

However, this is not just a cyclical shortage driven by a mismatch in supply and demand, but a potentially permanent, strategic reallocation of the world’s silicon wafer capacity. For decades, the production of DRAM and NAND Flash for smartphones and PCs was the primary driver for production. Today, that dynamic has inverted. The voracious demand for HBM by hyperscalers, such as Microsoft, Google, Meta and Amazon, has forced the three biggest memory manufacturers (Samsung Electronics, SK Hynix, and Micron Technology) to pivot their limited cleanroom space and capital expenditure towards higher margin enterprise-grade components. This is a zero-sum game: every wafer allocated to an HBM stack for an Nvidia GPU is a wafer denied to the LPDDR5X module of a mid-range smartphone or the SSD of a consumer laptop.

As a result, IDC expects 2026 DRAM and NAND supply growth be below historical norms at 16% year-on-year and 17% year-on-year, respectively.

The Crisis in the Devices Market

The result of this supply/demand imbalance is twofold: DRAM and NAND/SSD prices have risen sharply in recent months, and the availability of these components is limited, forcing device manufacturers to navigate a fluid situation.

The Potential Smartphone Market Impact

The global smartphone market, particularly Android manufacturers, is facing a threat in 2026. The industry’s decade-long trend of democratizing specs by bringing flagship features to affordable smartphones is reversing.

The cost structure of a smartphone is heavily dependent on the memory used. For a mid-range device, memory can represent 15-20% of the total bill of materials (BOM), while for a high-end flagship device, it is around 10-15%. As memory prices continue to surge, OEMs will likely have to raise prices significantly, cut specifications or both.

Different Vendors, Different Impacts

The impact of the shortage is highly asymmetric, creating winners and losers on supply chain resilience and vertical integration.

Manufacturers, whose business is mainly in the low end of the market, are likely to suffer significantly. The business models of vendors such as TCL, Transsion, Realme, Xiaomi, Lenovo, Oppo, Vivo, Honor or Huawei are based on thin margins. This increase in cost will hit their margins substantially, and they will have no other option but to pass the cost (or part) to end users.

In the high end of the market, Apple and Samsung face pressure but are structurally hedged. Its cash reserves and long-term supply agreements allow it to secure memory supply 12-24 months in advance. On the other hand, new flagship models in 2026 will likely have no RAM upgrades, sticking to 12GB for Pro models rather than increasing to 16GB. It is also unlikely that current models will see the same price erosion seen after the introduction of the latest model.

The cumulative effect of these pressures is a potential contraction in the global smartphone market alongside an increase in average selling prices (ASP). In 2026, in our moderate downside scenario, we could see the market contract by 2.9%. In our pessimistic downside scenario, it could be as bad as 5.2%. The severity of each scenario depends on how long this situation lasts.

At the same time, smartphone ASPs could rise by 3% to 5% in the moderate scenario, or by 6% to 8% in the pessimistic scenario. These price rises will be significantly higher in the low end of the market, where margins are extremely tight, and OEMs will have to pass the cost to end users.

But regardless of the severity of the scenario, longer replacement cycles are likely to occur in markets with rising costs causing lower purchasing power. By contrast, in more mature markets, consumers are likely to rely on financing and instalment plans to absorb higher prices.

While there could be significant downside risk to volumes in 2026, we expect 4Q25 to outperform our earlier projections as vendors stocked channels ahead of price increases.

Impact to the PC Market

If the smartphone market is facing pressure, the PC market is bracing for disruption. The timing of the memory shortage creates a perfect storm for the PC industry, colliding with the Microsoft Windows 10 end-of-life refresh cycle and the AI PC marketing push.

PC vendors are signalling broad price increases as cost pressures intensify into H2 2026. Lenovo, Dell, HP, Acer and ASUS have warned clients of tougher conditions ahead, confirming 15-20% hikes and contract resets as an industry-wide response.

PC vendors with larger shipment volumes should be better positioned to navigate current supply constraints, enabling them to capture market share from smaller and regional brands. Regardless of how much the total market size may be impacted, we expect vendor market shares to shift in favor of the largest vendors armed with inventory and greater leverage with suppliers.

White box as well as lower tier (often local) vendors, on the other hand, will bear the greatest burden of the shortage, and that would include DIY systems, oftentimes built by gamers. That in turn represents an opportunity for large OEMs to gain share from smaller assemblers in the gaming space by positioning pre-built systems as offering higher value.

The Impact on AI PC

The shortage threatens to derail the industry’s growth narrative around AI PC. IDC defines the AI PC as any PC with an NPU. Crucially, these devices tend to have more RAM (Microsoft’s Copilot+ PCs require a minimum of 16GB). As more small language models and large language models move on device, memory becomes even more important, with many higher-end systems shifting toward 32GB or higher. Just as the industry is seeing a need to add more RAM, it has become prohibitively expensive to do so, even if they can get supply. This will result in higher prices, lower margins, or a potential downmix in the amount of RAM in new systems at the worst possible time for this to occur.

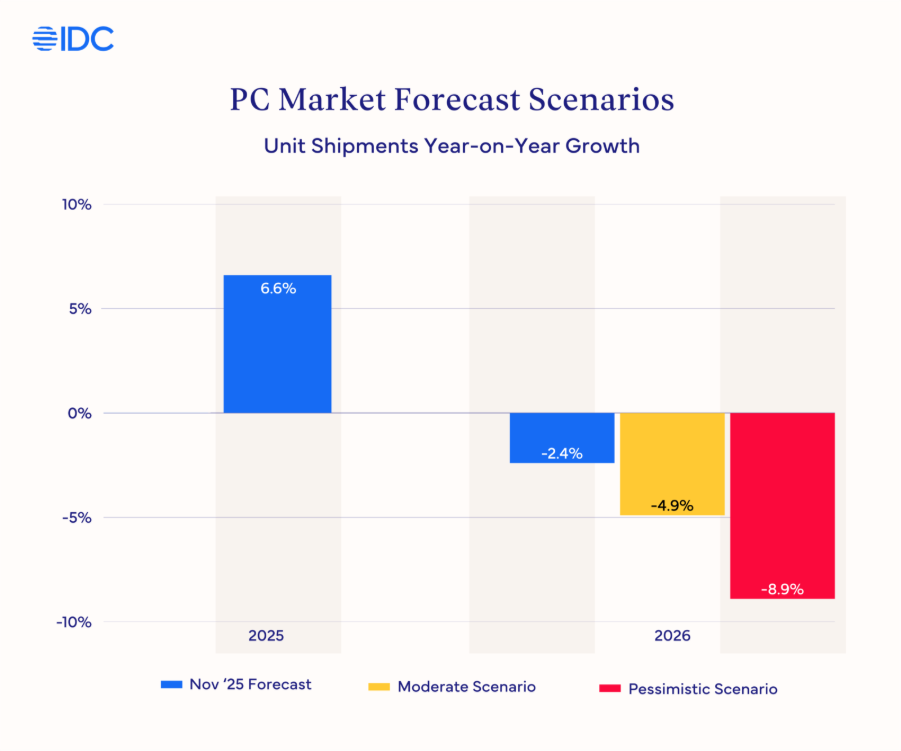

As with smartphones, IDC is not changing its official PC forecast. Here again, we offer two potential scenarios for 2026.

In the more moderate downside scenario, we could see the PC market contract by 4.9% compared with a 2.4% year-on-year decline in the November forecast. Under a more pessimistic scenario, the decline could deepen to 8.9%. The severity of each scenario will largely depend on how long the current supply constraints persist through 2026.

Under these downside scenarios, PC average selling prices would likely rise, increasing by 4% to 6% in a moderate scenario, and by 6% to 8% in a pessimistic scenario.

As with smartphones, channels are building inventory in advance to mitigate the impact of further price increases in the months ahead, which is expected to support stronger-than-expected forecast performance in Q4 2025, relative to the November outlook.

Conclusion

What began as an AI infrastructure boom has now rippled outward, with tightening memory supply, inflating prices, and reshaping product and pricing strategies across both consumer and enterprise devices. As the industry adjusts to this new reality, the smartphone and PC markets are bracing for a period of higher costs, altered product roadmaps, and slower volume growth. The severity and duration of the shortage will be determined by how quickly production capacity can expand and how effectively demand rebalances across segments.

For consumers and enterprises alike, this signals the end of an era of cheap, abundant memory and storage, at least in the medium term. The year 2026 is shaping up to be one in which technology becomes more expensive, driven by supply constraints rather than demand growth.