BOSTON, February 5, 2026 – Worldwide spending on artificial intelligence (AI) infrastructure reached a record $86 billion in Q3 2025, marking a sustained investment cycle as platform providers scale capacity for training and inference workloads, according to the IDC Worldwide Quarterly Artificial Intelligence Infrastructure Tracker.

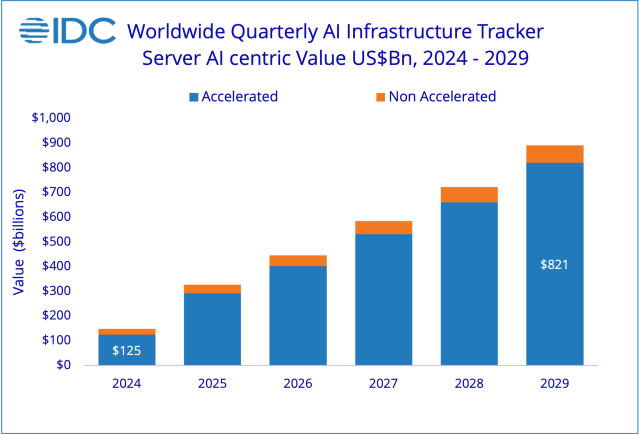

The record performance in Q3 2025 signals a shift from initial pilot phases into a multi-year expansion, with full-year 2025 spending projected to reach $334 billion and more than $902 billion by 2029. Growth is expected to remain above 30% annually through 2027, before moderating into the mid-20% range in the latter years of the forecast.

The results highlight the central role of accelerated compute as enterprises and cloud providers move to support increasingly complex AI workloads.

Why AI Infrastructure Grew in Q3 2025

Growth in Q3 was driven by massive capital investment from AI platform providers and hyperscalers, with hardware categories expanding to meet the rigorous data demands of large language models (LLMs).

- Servers dominated the market, accounting for $84.0 billion (nearly 98%) of total AI-centric spending.

- Cloud and Shared Deployments represented over 86% of the market, reflecting the industry’s reliance on scalable infrastructure.

- AI-Centric Storage reached $1.76 billion, driven by the need for high-performance repositories for model training and inference checkpoints.

Accelerated Compute and GPU Demand Accelerate Growth

Accelerated servers remain the foundation of AI infrastructure. While YoY growth moderated from earlier peaks in 2025, spending levels remained elevated, signaling sustained demand rather than a pullback in investment. Both x86 and non-x86 systems saw strong adoption as AI platforms scaled infrastructure to meet rising training and inference requirements.

Regional Growth Led by the United States and China

Geography played a major role in the Q3 surge, with two regions leading the global investment landscape:

- The United States is expected to remain the largest AI infrastructure market in 2025, accounting for approximately 76% of global spending with investment projected to grow from $254 billion in 2025 to nearly $708 billion by 2029. Growth is driven by hyperscalers and AI platform leaders expanding large-scale data center capacity.

- China (PRC) is expected to be the second fastest-growing major region over the forecast period, with spending projected to increase from $39.1 billion in 2025 to more than $139 billion by 2029, supported by continued investment in domestic AI platforms and sovereign AI initiatives.

IDC Analyst Commentary

“The AI infrastructure market has clearly moved beyond an initial deployment phase into a sustained expansion cycle,” said Lidice Fernandez, group vice president, Worldwide Enterprise Infrastructure Trackers at IDC. “Public investment signals from leading AI platform providers point to multi-year commitments to infrastructure expansion, particularly around accelerated compute. These investments reflect long-term confidence in the growth of AI workloads across consumer, enterprise, and research use cases.”

FAQs

- Why did the AI infrastructure market grow despite moderating growth rates?

Moderating growth rates just means the pace of growth slowed versus an earlier surge not that the market stopped expanding. AI infrastructure can still grow since hyperscalers and large enterprises are still in a capacity expansion cycle to support GenAI training and, increasingly, inference at scale supporting continued positive IT infrastructure spend. After a breakout year like 2025 where the AI market spending more than doubled, the market is much larger, so even a lower percentage growth rate can still translate into huge incremental spending.

- Which regions benefited most from the 3Q25 trend?

The United States keeps leading investment and growing triple digit (+109%) for the fifth consecutive quarter representing 75% of the global spending. PRC, the second largest region in size, showed a relatively modest 21% growth as they experienced challenges on component availability due to global trade restrictions. APeJC growth of +60% in the quarter representing almost 5% of the global spending, is benefiting from hyperscalers and regional and cloud service providers expansion and partnering with NVIDIA and multiple OEM hardware vendors to address localized AI deployment and data sovereignty requirements. Western Europe, the 4th in size, also had a very solid quarter by growing 62%, with ARM-based systems gaining momentum, particularly among hyperscalers, national AI programs, and large enterprises focused on performance and energy efficiency. At the same time, large-scale GPU deployments are expanding across the region. Japan, the 5th region in size grew by 27% in the quarter while MEA increased 98% thanks to targeted investments in the Middle East region. Canada showed the fastest growth (+126%) even though it only represents 0.5% of the global revenue. Lastly Latin America grew 24% and CEE 89%.

- What risks could impact the market next?

Power generation capacity is becoming the main bottleneck for deploying GPU servers on a scale. If utilities can’t deliver MW on schedule, data center commissioning gets delayed and could stall spending. Higher power costs can slow projects or change site selection for future facilities.

Also, the increasing costs and scarcity of parts such as disks and memory could also negatively impact infrastructure demand as IT budgets may be closed to a limit on expansion terms. Tight memory supply and rising prices can lift AI server BOMs and create slowdown in investments.

Regulatory and data-sovereignty requirements (where workloads can run) will determine compliance and localization and could reshape where capacity is built and who wins enterprise deals (and can add cost/complexity).

Export controls can determine rules and licensing across the globe and create uncertainty.

Taxonomy Notes

IDC defines AI type considered AI centric in the server and storage categories, including systems that run one or more of the following applications:

- AI platforms dedicated to AI application development; most AI training occurs here.

- AI applications whose prime function is to execute AI models; most AI inferencing happens in this category.

- AI-enabled (traditional) applications with some AI functionality

- AI application development and deployment (AD&D) software used to develop AI models and applications

The full taxonomy, including definitions, can be found in IDC’s Worldwide Artificial Intelligence Infrastructure Tracker Taxonomy, 2025. Fundamentally, the reporting of AI hardware in the AI Infrastructure Tracker a “workloads based” view of the server and storage markets, defined in IDC’s Worldwide Semiannual Enterprise Infrastructure Tracker: Workloads Taxonomy, 2024.)

IDC’s Worldwide Quarterly AI Infrastructure Tracker® is a comprehensive global data tool that details vendor share and forecast information on server and storage systems running artificial intelligence (AI) applications. The tracker is built on the strong foundation of IDC’s vendor product and market modeling methodology, coupled with its extensive network of worldwide and local expertise across the globe, ensuring that the market competition and opportunities are represented true to reality.

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,000 analysts worldwide, IDC offers global, regional, and local expertise on technology, IT benchmarking and sourcing, and industry opportunities and trends in over 100 countries. IDC’s analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is the world’s leading tech media, data, and marketing services company. To learn more about IDC, please visit www.idc.com. Follow IDC on X at @IDC and LinkedIn. Subscribe to the IDC Blog for industry news and insights.

-###-

All product and company names may be trademarks or registered trademarks of their respective holders.