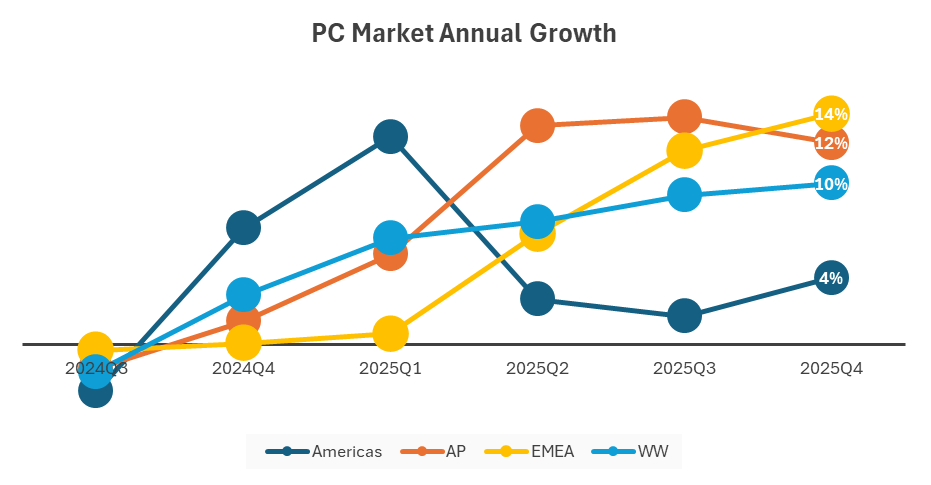

BOSTON, Mass., January 12, 2026 – Global PC shipments grew 9.6% year-over-year in the fourth quarter of 2025, reaching 76.4 million units, according to preliminary results from the International Data Corporation (IDC) Worldwide Quarterly Personal Computing Device Tracker. The results cap off a tumultuous year for the PC market, marked by the end of support for Windows 10, which drove a wave of upgrade demand, and early year tariff concerns that prompted vendors to pull forward more inventory than originally planned. While the holiday season typically drives stronger demand, the surge in late 2025 was further amplified by emerging memory shortages that led buyers and brands to secure inventory ahead of anticipated price increases in 2026.

“IDC expects that the PC market will be far different in 12 months given how quickly the memory situation is evolving,” said Jean Philippe Bouchard, research vice-president with IDC’s Worldwide Mobile Device Trackers. “Beyond the obvious pressure on prices of systems, already announced by certain manufacturers, we might also see PC memory specifications be lowered on average to preserve memory inventory on hand. The year ahead is shaping up to be extremely volatile.”

“Memory shortages are affecting the entire industry, and the impact will likely reshape market dynamics over the next two years,” said Jitesh Ubrani, research manager with IDC’s Worldwide Mobile Device Trackers. “Large consumer electronics brands are well positioned to leverage their scale and memory allocations to capture shares from smaller and regional vendors. However, the severity of the shortage raises the risk that smaller brands may not survive, and consumers, particularly DIY enthusiasts, may delay purchases or shift their spending to other devices or experiences.”

In addition to potential market share shifts, average selling prices (ASPs) are expected to rise in 2026 as vendors prioritize midrange and premium systems to offset higher component costs, especially memory. While total unit shipments may soften, overall market value is projected to increase as component suppliers, PC manufacturers, and channel partners adjust pricing to ensure they capture revenue opportunities amid another supply constrained environment.

| Top 5 Companies, Worldwide Traditional PC Shipments, Market Share, and Year-Over-Year Growth, Q4 2025 (Preliminary results, shipments are in millions of units) | |||||

| Company | 4Q25 Shipments | 4Q25 Market Share | 4Q24 Shipments | 4Q24 Market Share | 4Q25/4Q24 Growth |

| 1. Lenovo | 19.3 | 25.3% | 16.9 | 24.2% | 14.4% |

| 2. HP Inc | 15.4 | 20.1% | 13.7 | 19.7% | 12.1% |

| 3. Dell Technologies | 11.7 | 15.3% | 9.9 | 14.2% | 18.2% |

| 4. Apple | 7.1 | 9.3% | 7.1 | 10.2% | 0.2% |

| 5. ASUS | 5.4 | 7.1% | 4.9 | 7.0% | 10.9% |

| Others | 17.4 | 22.8% | 17.2 | 24.7% | 1.5% |

| Total | 76.4 | 100.0% | 69.7 | 100.0% | 9.6% |

| Source: IDC Quarterly Personal Computing Device Tracker, January 12, 2026 | |||||

| Top 5 Companies, Worldwide Traditional PC Shipments, Market Share, and Year-Over-Year Growth, 2025 vs. 2024 (Preliminary results, shipments are in millions of units) | |||||

| Company | 2025 Shipments | 2025 Market Share | 2024 Shipments | 2024 Market Share | 2025/2024 Growth |

| 1. Lenovo | 70.8 | 24.9% | 61.8 | 23.5% | 14.5% |

| 2. HP Inc. | 57.5 | 20.2% | 53.0 | 20.1% | 8.4% |

| 3. Dell Technologies | 41.1 | 14.4% | 39.1 | 14.8% | 5.2% |

| 4. Apple | 25.6 | 9.0% | 23.0 | 8.7% | 11.1% |

| 5. Asus | 20.5 | 7.2% | 18.0 | 6.8% | 13.4% |

| Others | 69.3 | 24.3% | 68.3 | 25.9% | 1.4% |

| Total | 284.7 | 100.0% | 263.3 | 100.0% | 8.1% |

| Source: IDC Quarterly Personal Computing Device Tracker, January 12, 2026 | |||||

Notes:

- IDC declares a statistical tie in the Personal Computing Device market when there is a difference of one-tenth of one percent (0.1%) or less in the shipment shares among two or more vendors. Traditional PCs include Desktops, Notebooks, and Workstations and do not include Tablets or x86 Servers. Detachable Tablets and Slate Tablets are part of the Personal Computing Device Tracker but are not addressed in this press release.

- Shipments include shipments to distribution channels or end users. OEM sales are counted under the company/brand under which they are sold.

IDC’s Worldwide Quarterly Personal Computing Device Tracker gathers detailed market data in over 90 countries. The research includes historical and forecast trend analysis, among other data. For more information or to subscribe to the research, please contact Jackie Kliem at 508-988-7984 or jkliem@idc.com.

About IDC Trackers

IDC Tracker products provide accurate and timely market size, company share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly Excel deliverables and on-line query tools.

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,000 analysts worldwide, IDC offers global, regional, and local expertise on technology, IT benchmarking and sourcing, and industry opportunities and trends in over 100 countries. IDC’s analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is the world’s leading tech media, data, and marketing services company. To learn more about IDC, please visit www.idc.com. Follow IDC on X at @IDC and LinkedIn. Subscribe to the IDC Blog for industry news and insights.

-###-

All product and company names may be trademarks or registered trademarks of their respective holders.