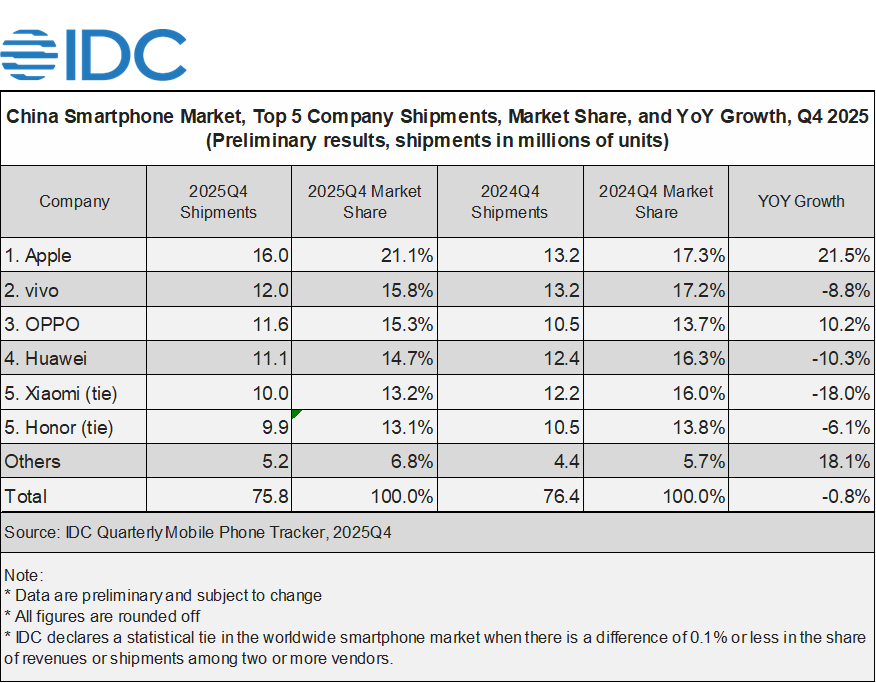

BEIJING and BOSTON, January 14, 2026 – According to preliminary data from the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker, China’s smartphone market shipped 75.8 million units in 4Q25, a slight 0.8% year-on-year (YoY) decline. Under the pressure of rising memory costs, the majority of domestic brands reduced low-end models’ shipments to protect profitability. Furthermore, as the stimulating effect of the government subsidy policies was limited, OEMs did not build up significant stock even with a new round of subsidies.

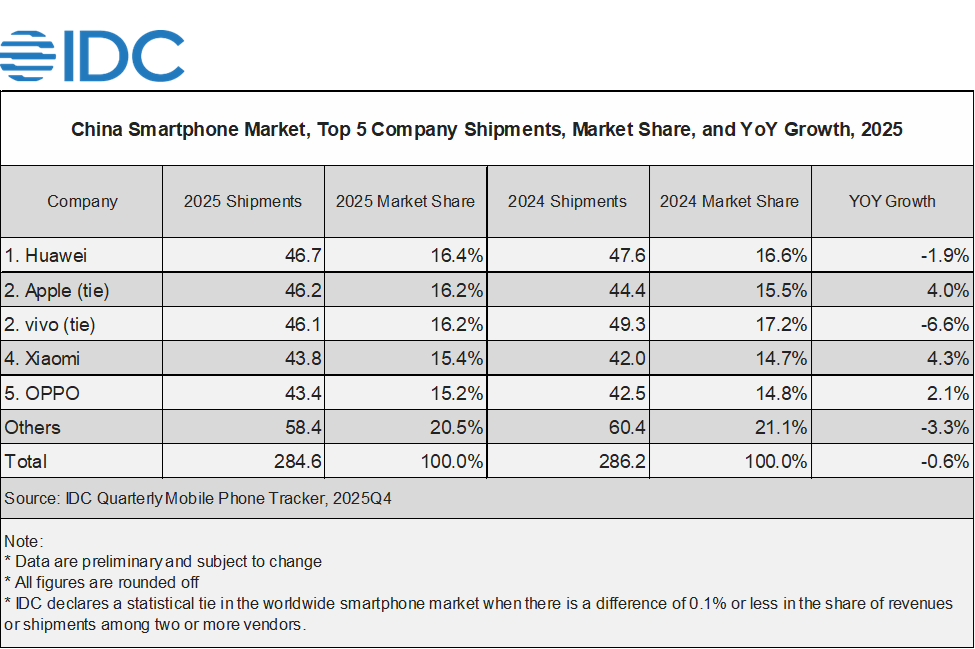

For the full year of 2025, smartphone shipments in China totaled approximately 285 million units, a YoY decline of 0.6%. At the beginning of the year, the government subsidies combined with the Lunar New Year peak season drove significant growth, though momentum subsequently waned. In the second half of the year, the market continued its decline, caused by rising memory costs and depleted subsidy funds.

“Apple climbed to the top spot and achieved the highest growth among the Top 5 players in the last quarter of 2025, driven by its popular iPhone 17 series as well as the strategic discounts on its iPhone 17 Pro and Pro Max to extend the sales momentum,” said Will Wong, senior research manager for Client Devices at IDC Asia/Pacific. “From the full-year perspective, Huawei led the market in a close race with Apple and vivo. Both Huawei and Apple demonstrated that a premium brand name is a key success factor in the long term, especially in a rising production cost environment.”

“Facing the trend of expected sharp increases in memory prices, cost pressures on smartphone OEMs are set to intensify,” said Arthur Guo, senior research analyst in Client System Research for IDC China. “Consequently, the smartphone market in China is expected to experience a more noticeable decline in 2026.”

-Ends-

About IDC Trackers

IDC Tracker products provide accurate and timely market size, company share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly Excel deliverables and on-line query tools.

For more information about IDC’s Worldwide Quarterly Mobile Phone Tracker, please contact Jackie Kliem at 508-988-7984 and jkliem@idc.com.

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events. With more than 1,000 analysts worldwide, IDC offers global, regional, and local expertise on technology, IT benchmarking and sourcing, and industry opportunities and trends in over 110 countries. IDC’s analysis and insights help IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is the world’s leading tech media, data, and marketing services company. To learn more about IDC, please visit idc.com/ap. Follow IDC on Twitter at @IDC and LinkedIn. Subscribe to the IDC Blog for industry news and insights.

Click here to learn about IDC’s full suite of data and research products and how you can leverage them to grow your business.