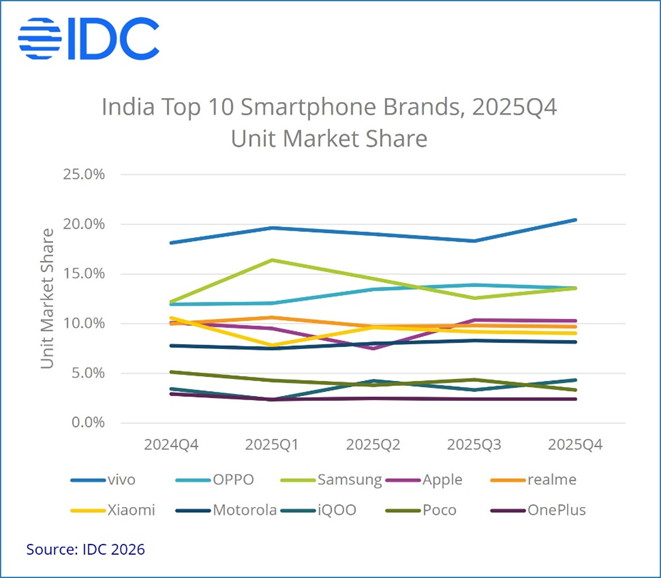

INDIA, February 16, 2026 – According to the International Data Corporation’s (IDC) Worldwide Quarterly Mobile Phone Tracker, India’s smartphone market closed 2025 on a flat note, growing marginally by 0.5% year-over-year to reach 152 million units. Following a subdued start to the year, shipments rebounded during the mid-year quarters (2Q–3Q25) before easing again in the final quarter. Shipments declined 5% YoY to 34 million units in the fourth quarter of 2025 (4Q25), as post-festive inventory normalization and cautious consumer spending weighed on demand.

India remained Apple’s fourth-largest global market in 2025, after the USA, China, and Japan, as the company reached a record 14 million shipments in the country, growing 16% YoY — the fastest growth among its top five global markets. Apple ranked fifth in India’s overall smartphone market with a 10% volume share while capturing a leading 29% share by value in 2025. Strong performance was driven by the iPhone 16, which accounted for 4% of total smartphone shipments in India during 2025.

“Contrary to the typical post-festive pattern of extended discounting and inventory clearance, the fourth quarter of 2025 recorded a notable increase in average selling prices (ASPs), which rose 4% year-over-year to US$279. This upward pressure on pricing, impacting both new and existing models, was driven by rising memory costs and a depreciating rupee. Together, these factors dampened consumer demand,“ said Aditya Rampal, Senior Research Analyst, Devices Research, IDC Asia Pacific.

Key Highlights for 2025:

Smartphone average selling prices (ASPs) rose 8% YoY to a record US$282 in 2025, driven by higher component costs and sustained consumer demand for premium and feature-rich models.

- Entry-Level (Sub-US$100):

The entry-level segment grew strongly by 18% YoY, expanding its share to 16% from 14% a year earlier. Xiaomi and vivo led the category, together accounting for over 40% of shipments. Motorola recorded the fastest growth in this segment, with shipments increasing nearly 2.4 times. - Mass-Budget (US$100–US$200):

Shipments in the mass-budget segment declined 8% YoY, reducing its market share from 44% to 41%. Among the top five brands, vivo, OPPO, and Motorola gained share, with the vivo T4X and OPPO A5 emerging as the top-shipped models. - Entry-Premium (US$200–US$400):

The entry-premium segment registered a 5% YoY decline in shipments, with its share easing from 28% to 26%. Despite the overall segment contraction, vivo, Samsung, and Motorola posted strong growth. The Motorola Edge 60 Fusion was the highest-shipped model in this price band. - Mid-Premium (US$400–US$600):

The mid-premium segment expanded 23% YoY, increasing its share from 4% to 5% in 2025. Apple led the segment, followed by Samsung and OPPO. Key models driving shipments included the OPPO Reno 13 Pro, iPhone 13, and Samsung Galaxy A56/S24. - Premium (US$600–US$800):

The premium segment recorded the fastest growth at 37% YoY, with its share rising from 4% to 5%. Apple dominated the category with a 74% share, led by the iPhone 16, iPhone 15, and iPhone 17, which together accounted for over 65% of shipments. - Super-Premium (US$800 and above):

The super-premium segment grew 7% YoY, with its share steady at 7%. Apple maintained leadership with a 63% share, while Samsung’s shipments increased by 1.8x, lifting its share to 34%. The segment was primarily driven by the iPhone 16 and Samsung Galaxy S24 Ultra/S25 Ultra models.

Qualcomm-based smartphone shipments grew 23% YoY in 2025, increasing their market share to 30%. This growth was largely driven by strong shipments of Xiaomi/POCO/OPPO/Nothing devices. In contrast, MediaTek’s share declined to 46%, down from 54% a year ago, following a 15% YoY drop in shipments.

The offline channel recorded its highest shipment levels in the past six years, growing 12% YoY and expanding its market share to 57%, up from 51% in 2024. In contrast, the online channel’s share declined to 43% from 49%, with shipments falling 12% YoY. A balanced omnichannel strategy, supported by attractive trade margins and consistent cross-channel pricing, fueled steady offline expansion throughout 2025. While e-tailers remained competitive, the most aggressive festive-season promotions were concentrated in the premium segment, leaving entry-level and lower mid-range Android smartphones facing weaker upgrade demand.

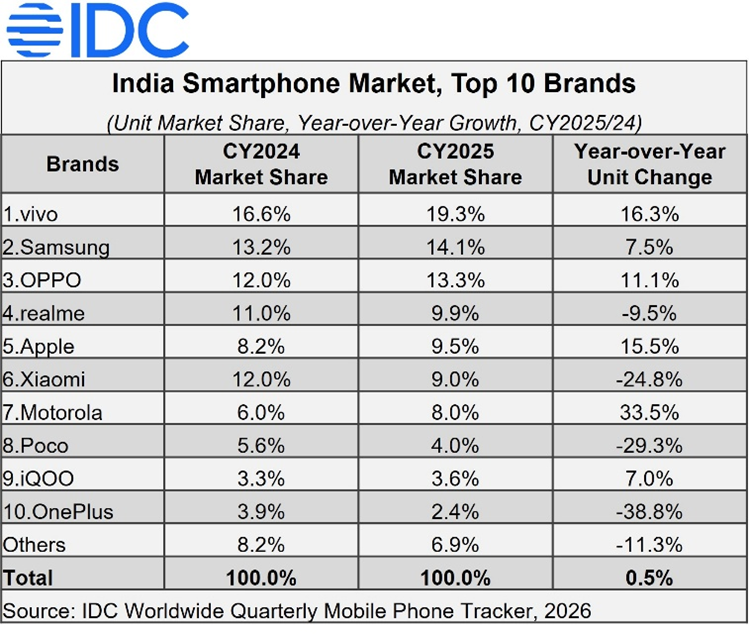

The top three vendor rankings remained unchanged in 2025, with vivo strengthening its leadership through a diversified product portfolio and a well-executed omnichannel strategy. Samsung followed, supported by its premium-focused approach, while OPPO retained its position on the back of a strong offline presence. As Xiaomi’s market share declined, brands such as realme, Motorola, and iQOO capitalized on the shift to improve their rankings. Additionally, Nothing emerged as the fastest-growing brand in 2025, posting a significant 45% YoY increase. According to IDC, scale and diversification emerged as key success factors in 2025: vendors with broad channel reach were better able to sustain volumes, whereas those heavily reliant on the entry-level segment faced mounting pressures.

“Despite stagnant shipments in a challenging 2025, India’s smartphone market delivered a strong 9% year-over-year value growth, driven by continued premiumization across both new and older flagship models. Looking ahead, IDC expects volumes to contract in 2026 amid an unprecedented global memory shortage. However, sustained premium demand and finance-led purchasing are likely to support value growth even as shipments soften. Recent price increases in the Android ecosystem also point toward market consolidation, where scale will be critical for vendors to secure supply and manage pricing,” said Upasana Joshi, Senior Research Manager, Devices Research, IDC Asia Pacific.

Note: This chart/table shows data by IDC’s Brand field. Company ranking may differ where Companies own more than one Brand.

*Figures in tables/charts rounded to the first decimal point.

-Ends-

For more information about IDC’s tracker products and research services, please contact Shivani Anand, Senior Marketing Specialist at sanand@idc.com. You can also follow IDC India’s Twitter and LinkedIn pages for regular updates.

About IDC Trackers

IDC Tracker products provide accurate and timely market size, company share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly Excel deliverables and on-line query tools.

Click here to learn about IDC’s full suite of data products and how you can leverage them to grow your business.

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,100 analysts worldwide, IDC offers global, regional, and local expertise on technology, IT benchmarking and sourcing, and industry opportunities and trends in over 110 countries. IDC’s analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is a wholly owned subsidiary of International Data Group (IDG), the world’s leading tech media, data, and marketing services company. To learn more about IDC, please visit idc.com/ap. Follow IDC on Twitter at @IDC and LinkedIn. Subscribe to the IDC Blog for industry news and insights.

All product and company names may be trademarks or registered trademarks of their respective holders.