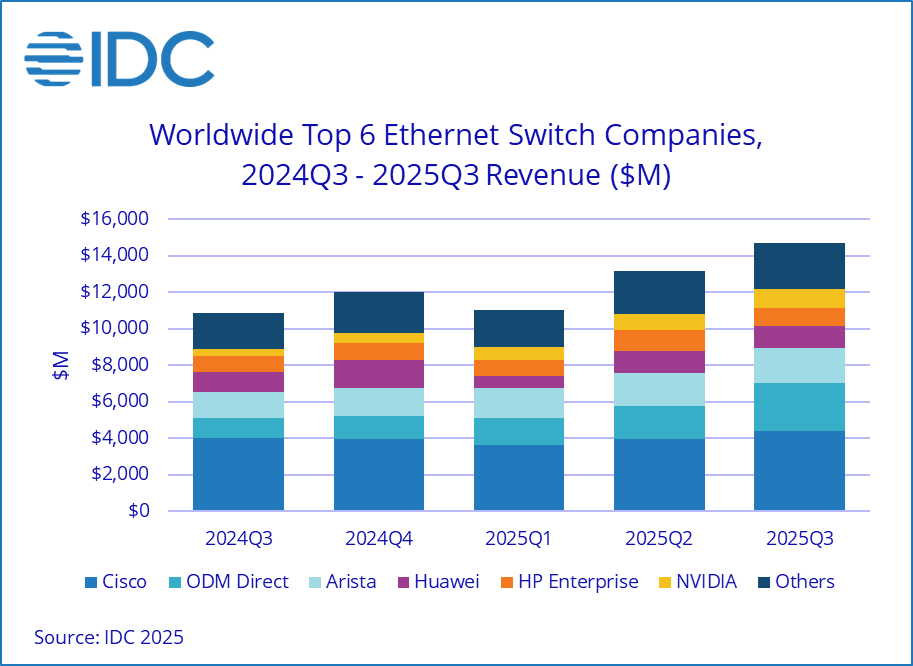

NEEDHAM, Mass., December 11, 2025 – The worldwide Ethernet switch market recorded $14.7 billion in revenue in the third quarter of 2025 (3Q25), a 35.2% year-over-year (YoY) increase, fueled by strong growth in the datacenter portion of the market as hyperscalers and cloud service providers race to build infrastructure capacity for the AI era. The total worldwide enterprise and service provider (SP) router market increased 15.8% YoY to $3.6B in 3Q25. These findings are detailed in the latest editions of the International Data Corporation (IDC) Quarterly Ethernet Switch Tracker and IDC Quarterly Router Tracker.

Ethernet Switch Market Highlights

Robust growth in the datacenter (DC) portion of the Ethernet switch market continued in 3Q25 as deployments of high-bandwidth, low-latency network infrastructure to support AI workloads accelerate. The datacenter portion of the Ethernet switch market increased 62.0% YoY, and rose 18.2% from the previous quarter, 2Q25. Year to date, the Ethernet switch market is up 49.6% compared to the first three quarters of 2024.

Revenues in the DC segment of the Ethernet switch market are being driven by the highest-speed ports. Revenues for 800GbE switches rose 91.6% sequentially and now make up 18.3% of the DC portion’s revenue in 3Q25. Revenues for 200/400 GbE switches deployed in the datacenter rose 97.8% YoY in 3Q25 and now make up 43.9% of the DC segment’s revenues. ODM (original device manufacturer) Direct sales continue to be a growing part of the datacenter segment, rising 152.4% YoY in 3Q25, and comprising 30.2% of the DC segment’s revenues in the quarter.

The non-datacenter (non-DC) segment, which includes Ethernet switches primarily used in enterprise campus and branch networks, increased 8.2% YoY in 3Q25. In the non-DC segment, 1GbE switch revenues rose 1.2% YoY in 3Q25; 10 GbE revenues rose 14.3% YoY and 25/50GbE switching showed solid growth, increasing 20.9% YoY.

From a geographic perspective, in the Americas, the total Ethernet switch market increased 41.6% YoY, driven by an increase in the DC portion of the market of 66.1% in the United States. In the Europe, Middle East & Africa region (EMEA), the total Ethernet switch market increased 24.7% YoY while in the Asia Pacific region, the market increased 32.7% YoY.

“The accelerated adoption of artificial intelligence is underpinning significant expansion in the global Ethernet switch market, particularly within the datacenter segment, as hyperscalers, service providers, and enterprises expand network infrastructure to meet the demands of AI-driven workloads,” says Brandon Butler, senior research manager, Enterprise Networks. “Concurrently, the non-datacenter Ethernet switch market continues to grow as organizations increase investments in campus and branch networking capabilities, leveraging AI-enhanced management and automation tools to strengthen and modernize their network foundations.”

Router Market Highlights

The service provider segment of the router market, which includes both communications SPs and cloud SPs, made up 74.0% of the total router market in 3Q25 and increased 20.2% YoY in 3Q25. The enterprise segment accounts for the remaining balance of the market and rose 4.7 YoY in 3Q25. From a regional perspective, the total router market in the Americas rose 31.5% YoY; the market increased 7.7% YoY in the APJ region and rose 3.5% YoY in EMEA.

Vendor Highlights

Cisco’s total Ethernet switch revenues increased 8.9% YoY in 3Q25 to reach $4.4 billion, giving the company share of 29.8%. Revenues in the non-DC segment – which make up 65.2% of Cisco’s total Ethernet switch revenue – increased 5.0% YoY. In the DC segment, revenues rose 16.9% YoY. Cisco’s total router revenue increased 31.9% YoY in 3Q25, giving the company market share of 37.5%.

Arista Networks’ Ethernet switch revenues 90.7% of which are in the DC segment increased 29.1% YoY in 3Q25 to $1.9B, giving the company 12.8% market share for the total Ethernet switch market and 19.2% share in the DC segment of the market.

NVIDIA’s Ethernet switch revenues, which are 100% in the DC segment, rose 167.7% YoY to reach $1.0 billion. NVIDIA holds 11.6% share in the DC segment of the market.

Huawei’s total Ethernet switch revenue increased 15.2% YoY in 3Q25 to $1.2 billion, giving the company a market share of 8.2%. Huawei’s router revenue increased 1.1% in 3Q25, giving the company 23.2% market share.

HPE‘s total Ethernet switch revenue 70.9% of which are in the non-DC segment increased 24.7% YoY in 3Q25, giving the company 12.5% market share. Following the July 2025 acquisition, HPE revenues now also include Juniper.

About IDC Trackers

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly excel deliverables and online query tools.

About IDC

International Data Corporation (IDC) is the premier global provider of trusted technology intelligence, advisory services, and events. With more than 1,000 analysts worldwide, IDC offers global, regional, and local expertise on technology, IT benchmarking and sourcing, and industry opportunities and trends in over 100 countries. IDC’s analysis and insights help IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. To learn more about IDC, please visit www.idc.com. Follow IDC on X at @IDC and LinkedIn. Subscribe to the IDC Blog for industry news and insights.