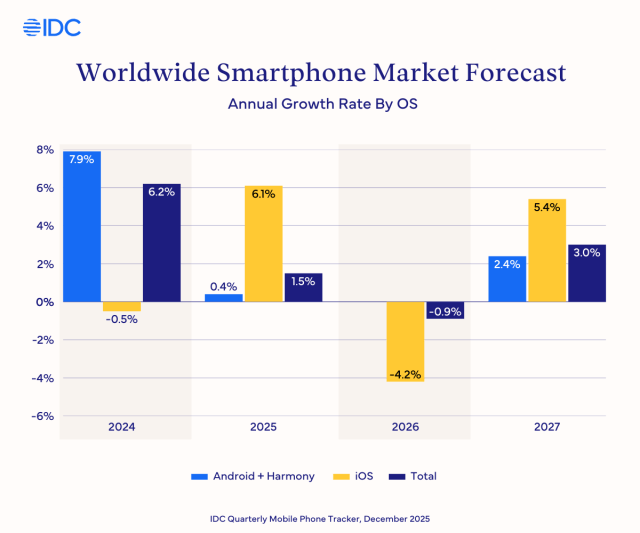

NEEDHAM, Mass., December 2, 2025 – Worldwide smartphone shipments are forecast to grow 1.5% year-on-year (YoY) in 2025 to 1.25 billion units, according to the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker. This is an increase from 1% growth in prior forecast, primarily driven by accelerated performance from Apple in the holiday quarter, rapid growth in key emerging markets and stabilization in China. Apple’s shipments are forecast to grow 6.1% YoY in 2025, up sharply from 3.9% in the last cycle.

“Apple is set to have a record year in 2025 with shipments forecast to cross 247 million units, thanks to the phenomenal success of its latest iPhone 17 series,” said Nabila Popal, senior research director with IDC’s Worldwide Quarterly Mobile Phone Tracker. “In China, Apple’s largest market, massive demand for iPhone 17 has significantly accelerated Apple’s performance. It ranked first in October and November per IDC’s China Monthly Sales data with more than 20% share, miles ahead of the competition, leading IDC to revise Apple’s Q4 forecast in China from 9% to 17% YoY. This turns a previously projected 1% decline in China for 2025 into a positive 3% growth, that’s a phenomenal turnaround. The success story is replicated across all regions, including the US and Western Europe that had previously slowed down. This calendar year will not only be a record period for Apple in terms of shipments but also in value, which is forecast to exceed $261 billion, with 7.2% YoY growth in 2025.”

While the near-term forecast for smartphones has strengthened, 2026 growth has been revised downward from 1.2% growth to 0.9% decline, due to a combination of component shortages and product cycle adjustments. Apple’s strategic shift of its next base iPhone model from fall 2026 to early 2027 is forecast to pull-down iOS shipments by 4.2% next year. Furthermore, the ongoing global memory shortage is expected to constrain supply and raise prices, which will impact low-to-mid range Android devices more significantly as they remain more price sensitive. As a result, smartphone units will face a soft decline in 2026, however ASP will increase to $465, propelling the market to its record high value of $578.9 billion.

“As memory components become more limited and more expensive, manufacturers face increasing pressure to raise prices,” said Anthony Scarsella, research director with IDC’s Worldwide Quarterly Mobile Phone Tracker. “Vendors need to adopt different strategies to protect their market share. While some OEMs will inevitably be forced to raise prices, others will adjust their portfolio towards pricier models with higher margins to absorb some of the memory impact on BOM. Next year will be a challenging time for the industry, however, IDC still believes the market could see record ASPs.”

About IDC Trackers

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly Excel deliverables and on-line query tools.

For more information about IDC’s Worldwide Quarterly Mobile Phone Tracker, please contact Jackie Kliem at 508-988-7984 and jkliem@idc.com.

Click here to learn about IDC’s full suite of data products and how you can leverage them to grow your business.

About IDC

International Data Corporation (IDC) is the premier global provider of trusted technology intelligence, advisory services, and events. With more than 1,000 analysts worldwide, IDC offers global, regional, and local expertise on technology, IT benchmarking and sourcing, and industry opportunities and trends in over 100 countries. IDC’s analysis and insights help IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. To learn more about IDC, please visit www.idc.com. Follow IDC on X at @IDC and LinkedIn. Subscribe to the IDC Blog for industry news and insights.

-###-

All product and company names may be trademarks or registered trademarks of their respective holders.