Belgrade, April 10, 2025 — According to the Worldwide Security Spending Guide published by International Data Corporation (IDC), European security spending is projected to grow by 11.8% year on year in 2025. Geopolitical developments, the intensification of cybercrime activity, and a tightening regulatory environment are driving organizations in Europe to adopt increasingly sophisticated defensive measures. Security spending is expected to remain robust throughout the 2023–2028 forecast period, reaching nearly $97 billion by 2028.

The Czech Republic and Hungary are expected to record the fastest growth in security spending in Europe in 2025, with year-on-year increases of 15.4% and 14.1%, respectively, as organizations in these countries continue to strengthen their security capabilities and align with advanced standards amid rapid digital transformation. The third-fastest-growing country in Europe in 2025 in terms of security spending will be Ireland, with a growth of 13.3% over 2024, reinforcing its position as a cutting-edge technology hub — including in the area of security.

Security software is projected to be the largest and fastest-growing technology group in Europe, accounting for over half of total security spending and with an expected year-on-year growth rate of 14.8%. This dynamic growth will be propelled by cloud native application protection platforms (CNAPP), identity and access management software, and security analytics software, as organizations are increasingly leveraging these techs to protect the expansion of their digital footprint.

“Cybersecurity spending in Europe reflects the shift that has occurred with security becoming a critical business enabler, and not just a technical necessity,” says Romain Fouchereau, senior research manager, IDC Security. “Geopolitical tensions, regulations, and the growing frequency of cyberthreats are driving organizations to prioritize cybersecurity as part of their broader strategic goals. To securely implement new technologies, businesses are creating resilient security frameworks to resist both cyberattacks and market disruptions. They are also looking at protecting complex IT environments while enabling secure and scalable digital transformation. This drives investment in more sophisticated security measures that align with business goals and long-term digital strategies.”

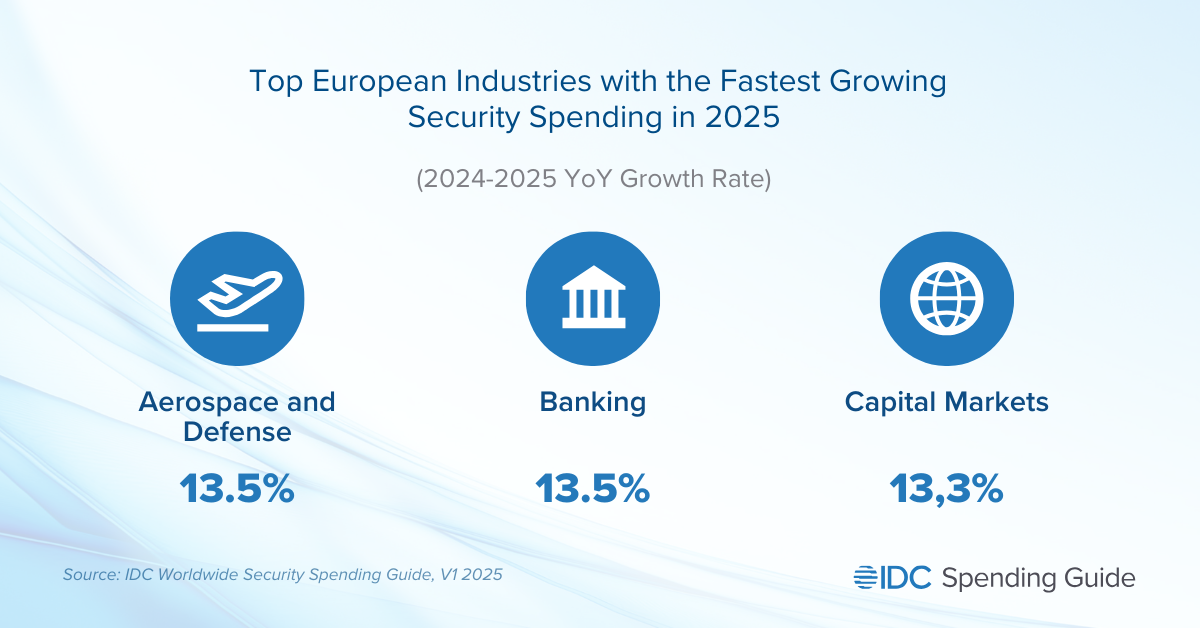

With regard to industries, Aerospace and Defense and Banking are projected to lead the European growth of security spending in 2025, each with a 13.5% year-on-year growth rate, followed closely by Capital Markets in third place with 13.3% growth.

“The dynamic geopolitical situation in Europe is significantly influencing the rise in security spending in critical industries like Aerospace and Defense and Utilities, as they aim to increasingly protect their infrastructure from cyberattacks. In addition, the increasing sophistication of cybercrime activities, compounded by the proliferation of generative AI, is also driving more companies to seek increasingly advanced security solutions. Finally, regulations such as NIS2 are bolstering security spending in industries like Banking and Capital Markets, which need to comply with stricter supervision and enhanced cybersecurity risk management,” notes Senior Research Analyst Vladimir Živadinović, IDC Data and Analytics.

Very large businesses (1,000+ employees) will remain the dominant segment for security spending in Europe in 2025, accounting for just under half of the total market. However, small and medium-sized businesses (10–499 employees) will see the fastest growth, driven by a higher incidence of cybercrime targeting this segment, increasing regulatory pressure, and growing awareness of security as a strategic business enabler.

About IDC Worldwide Security Spending Guide

IDC’s Worldwide Security Spending Guide quantifies both core and next-generation security spending for 28 industries and five company sizes across 39 technology markets and 48 countries.

About IDC Spending Guides

IDC’s Spending Guides provide a granular view of key technology markets from a regional, vertical industry, use case, buyer, and technology perspective. The spending guides are delivered via pivot table format or custom query tool, enabling the user to easily extract meaningful information about each market by viewing data trends and relationships.

For more information about IDC’s Spending Guides, please contact Monika Kumar.

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,300 analysts worldwide, IDC offers global, regional, and local expertise on technology, IT benchmarking and sourcing, and industry opportunities and trends in over 110 countries. IDC’s analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is a wholly owned subsidiary of International Data Group (IDG), the world’s leading tech media, data, and marketing services company. To learn more about IDC in Europe, please visit https://www.idc.com/eu. Follow IDC Europe on X at @IDC EMEA and LinkedIn. Subscribe to the European IDC Blog for industry news and insights.