Worldwide shipments of AR/VR headsets combined with display-less smart glasses are expected to grow 39.2% in 2025 with volumes reaching 14.3 million units. The market will be driven by smart glasses such as Meta’s Ray-Bans, with the category growing 247.5% during the year thanks to new product launches from Meta as well as numerous other companies joining the race to put artificial intelligence (AI) on consumers’ faces.

Meta held a huge lead in hardware as the company captured 60.6% of the combined AR/VR + display-less smart glasses market during the second quarter of 2025 (2Q25). Not only has the company found success in smart glasses thanks to the relatively lightweight form factor but the company also continues to lead in Mixed Reality as both categories are ultimately expected to lay the groundwork for true Augmented Reality glasses later down the road. Following Meta was Xiaomi with 7.7% share which was largely driven by the newly launched AI Glasses as well as the slightly older Mija Smart Glasses. However, unlike the global presence of other vendors, Xiaomi’s glasses were almost exclusively contained within China. XREAL (4.1%), RayNeo (2.7%), and Huawei (2.6%), rounded out the top five.

“It wasn’t long ago that consumers were introduced to AI on glasses and in recent quarters brands have also begun to include displays, enabling new use cases,” said Jitesh Ubrani, research manager for IDC’s Worldwide Mobile Device Trackers. “However, consumer awareness and product availability of AI glasses with display remains low, though this will change as Meta, Google, and others launch products in the next 18 months. Further pushing things forward will be the expansion of distribution channels as eyewear brands, opticians, and consumer electronics retailers ramp up availability and awareness.”

“Along with growing product availability, use cases and demographics are expected to shift from the gaming-heavy demand of today to a more mainstream audience, incorporating non-immersive experiences along with productivity, creativity, entertainment, and notification-rich use cases,” continued Ubrani.

Much of the software and services spending on AR/VR headsets is centered around gaming with games such as Animal Company, Beat Saber, and Gorilla Tag representing the top-grossing games during the first half of 2025. Outside gaming, AI apps are and usage are also gaining traction. In terms of hours of use, however, YouTube led the pack. IDC forecasts spending on apps, services, and related technologies to increase 19.7% in 2025, to nearly $12 billion worldwide.

As more brands, channels, and applications emerge, IDC forecasts the market will grow substantially, with hardware volumes reaching 43.1 million in 2029; the associated compound annual growth rate (CAGR) is 31.8%. Display-less glasses would still lead the market, as these glasses are expected to provide a low entry point into on-body AI for consumers, with Mixed Reality headsets and smart glasses with displays representing other major categories within the forecast.

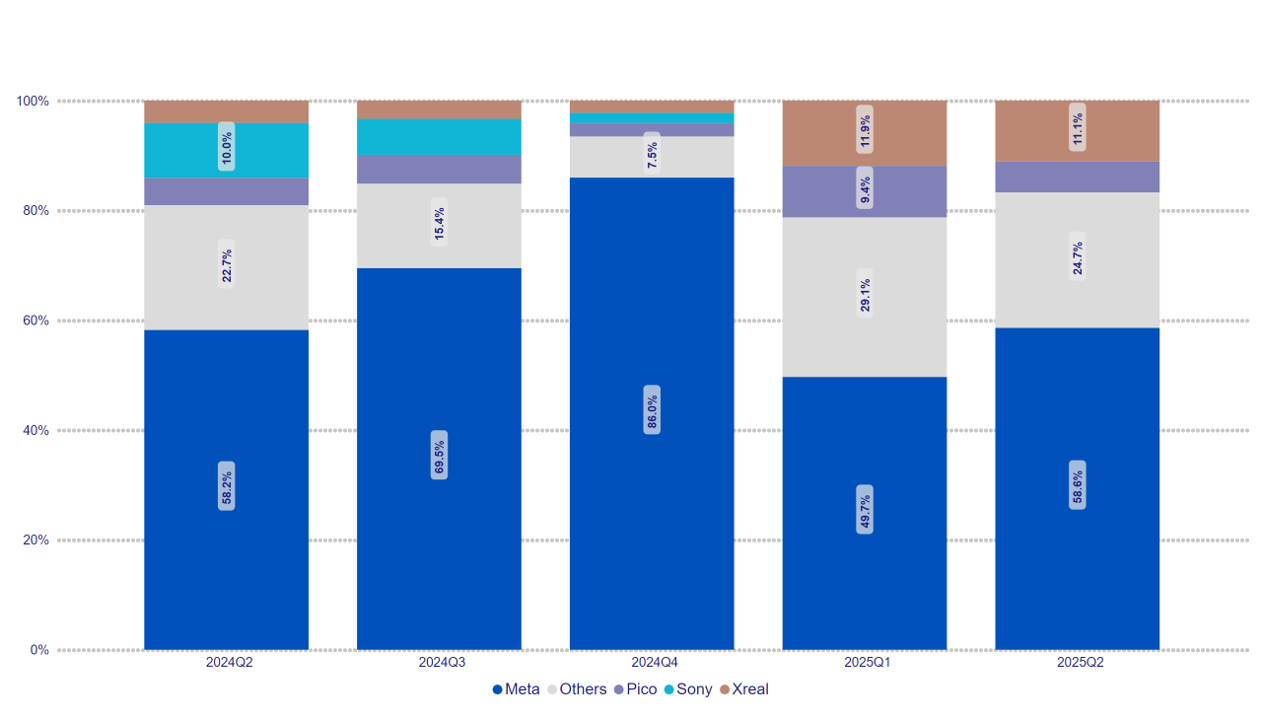

2025 Q2 Historical ARVR Market Share

| Quarter | Others | ByteDance | Meta | RayNeo | Viture | XREAL |

| 2024Q2 | 339,601 | 59,769 | 696,067 | 30,897 | 20,531 | 48,555 |

| 2024Q3 | 308,776 | 89,096 | 1,178,127 | 31,659 | 30,978 | 56,449 |

| 2024Q4 | 294,479 | 100,524 | 3,503,948 | 36,970 | 48,811 | 90,631 |

| 2025Q1 | 114,288 | 62,982 | 333,195 | 39,615 | 40,918 | 79,624 |

| 2025Q2 | 122,155 | 52,738 | 549,014 | 68,809 | 40,326 | 103,774 |