Worldwide Personal Computing Device (PCD) shipments grew 4.1% year-over-year in the third quarter of 2025 (3Q25), totaling 113.5 million units. Growth was driven by PC devices that posted growth of 8.9% compared to the prior year, with global volumes reaching 75.5 million units while tablets declined by 4.4% year-over-year with shipments totaling to 38 million units. Product refreshes from top vendors, stronger buying confidence, refreshes from Windows 10 end-of-support sales and continued sales from PRC subsidies – all contributed to the growth in the PCD market.

“While the entire PC market is continuing on a very strong year, fueled by Windows 11 transition and the need to replace an ageing installed base, the results by regions are telling different stories” said Jean Philippe Bouchard, research vice-president with IDC’s Worldwide Mobile Device Trackers. “In particular, the North American market continues to be impacted by the US import tariffs shock and by macroeconomic uncertainties. While existent, the demand for newer PCs ready for Windows 11 is likely to push well into 2026.”

The Asia/Pacific (including Japan and China) PC market recorded double-digit growth. “The demand was driven largely by Japan’s hardware refresh linked to Windows 10 end-of-support and the GIGA education project.” said Maciek Gornicki, Senior Research Analyst with IDC’s Worldwide Device Trackers. “Growth outside Japan was more modest – hindered by macroeconomic and political challenges and slow Windows 11 adoption – though there were pockets of opportunity from hardware refreshes of devices purchased during and before the COVID-19 pandemic.”

“The tablet market underscores a transition from pandemic-driven demand to steady, value-oriented growth,” said Anuroopa Nataraj, senior research analyst with IDC’s Mobility and Consumer Device Trackers. “Shipments are stabilizing as replacement cycles lengthen, but innovation in AI-powered features, detachable form factors, and display technology is helping sustain engagement across both consumer and enterprise segments. The market’s near-term trajectory points to selective recovery led by productivity-centric and mid-premium devices.”

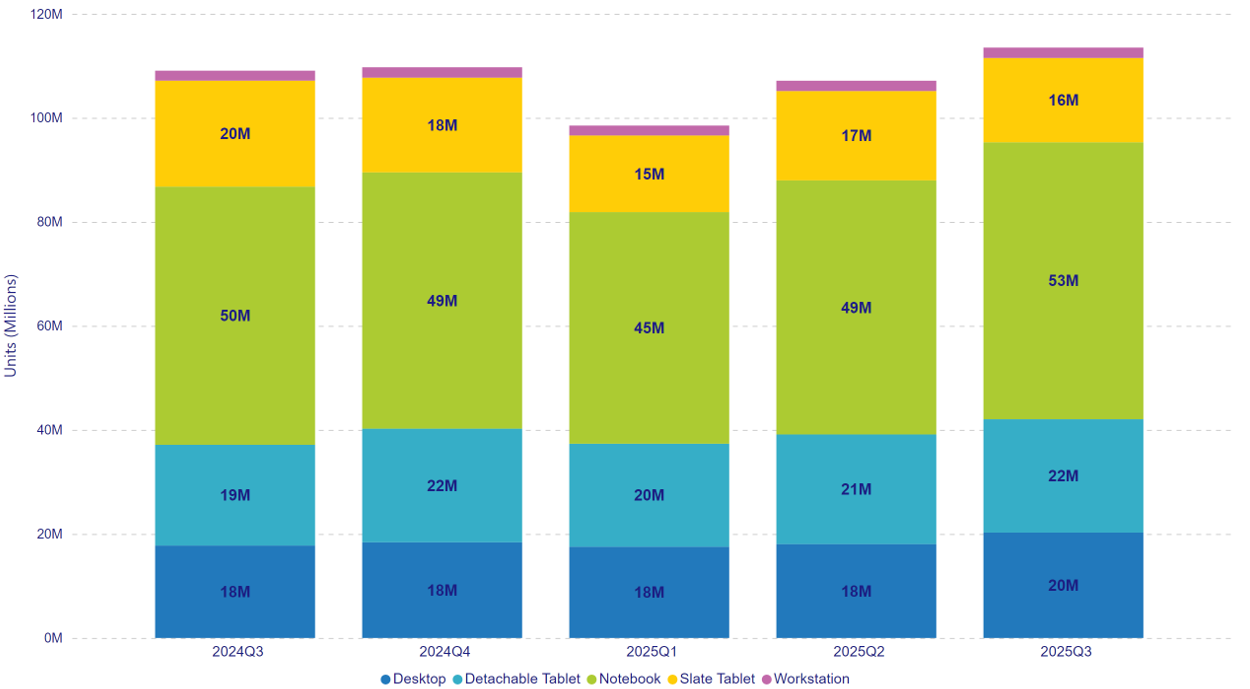

2025Q3 PCD Historical Promo Chart

| Quarter | Desktop | Detachable Tablet | Notebook | Slate Tablet | Workstation |

| 2024Q3 | 17,777,364 | 19,362,703 | 49,639,042 | 20,371,871 | 1,915,824 |

| 2024Q4 | 18,392,672 | 21,851,581 | 49,280,940 | 18,200,153 | 1,997,263 |

| 2025Q1 | 17,546,193 | 19,801,882 | 44,528,334 | 14,729,888 | 1,905,598 |

| 2025Q2 | 18,052,823 | 21,081,288 | 48,842,922 | 17,175,768 | 1,983,747 |

| 2025Q3 | 20,264,459 | 21,794,211 | 53,244,547 | 16,205,055 | 1,995,215 |