Worldwide Server Market grew by 97.3% in spending in the second quarter of 2025, driven by the continued mass deployment of GPU servers while keeping a 28.7% CAGR in a Five-Year Period, according to IDC.

The server market grew by 97.3% in spending in the second quarter of 2025. Unit growth was strong at 15.9% year over year. Non-accelerated server growth slowed as the refresh from 2024 appears to be ending. The market is well into an expansion process to support AI that has largely overshadowed macro-level challenges, including slowdown in economic activity, supply chain disruption, geopolitical conflict and rising tariffs. Large cloud service providers will continue their accelerated infrastructure expansion throughout the forecast period, while the rest of the market will try to find a balance for AI investments between on premises deployments and cloud services.

The market is expected to grow over the next five years at 28.7% CAGR by 2029. The debate about AI model efficiency reducing the need for further infrastructure investment has largely faded since the beginning of the year, as efficiency gains have not meaningfully slowed the pace of AI infrastructure buildouts. Despite technological advances that have driven some resource reductions, actual demand for both training and inference capacity continues to rise at a pace that outweighs these gains. The debate about AI model efficiency reducing the need for further infrastructure investment has largely faded since the beginning of the year, as efficiency gains have not meaningfully slowed the pace of AI infrastructure buildouts.

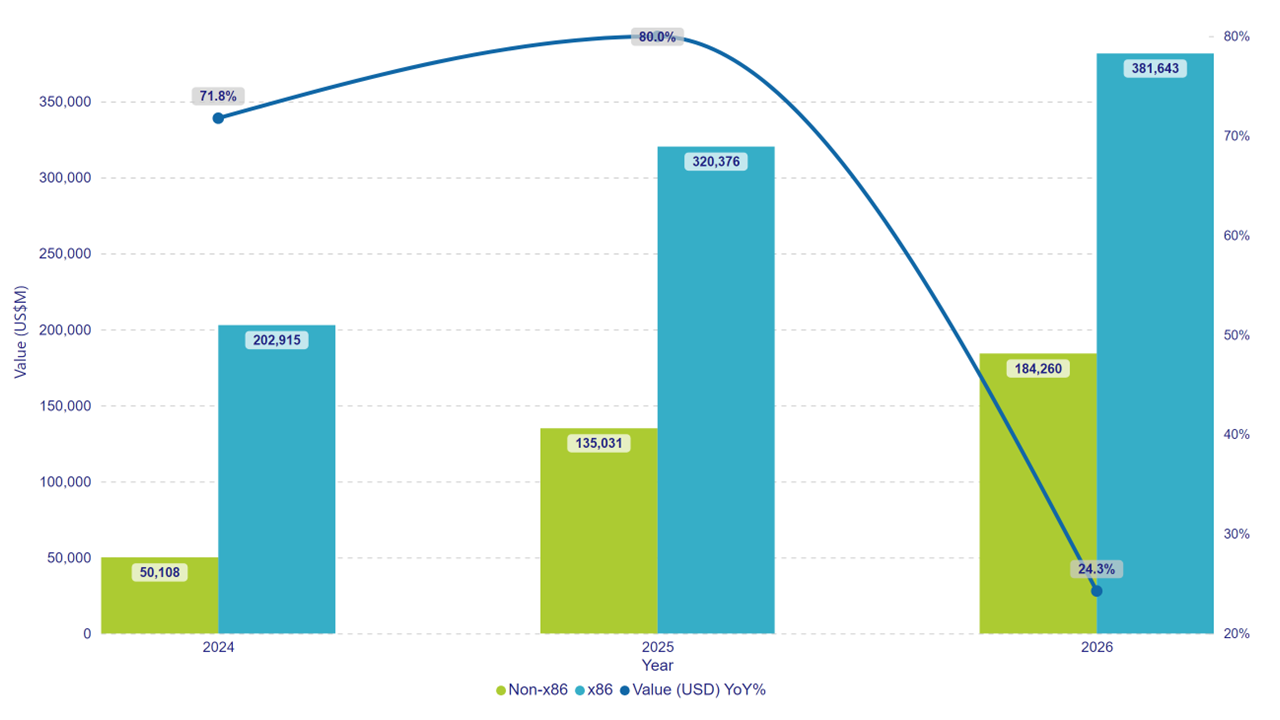

Worldwide Server Market Forecast 2024 – 2026 Value (US$M)

| Product Category | Non-x86 | x86 | Total | |||

| Date – Year | Value (US$M) | Annual Growth % | Value (US$M) | Annual Growth % | Value (US$M) | Annual Growth % |

| 2024 | $50,108 | 161.6% | $202,915 | 58.3% | $253,023 | 71.8% |

| 2025 | $135,031 | 169.5% | $320,376 | 57.9% | $455,407 | 80.0% |

| 2026 | $184,260 | 36.5% | $381,643 | 19.1% | $565,903 | 24.3% |