Global Wearables Market Surges in Q2 2025: Xiaomi’s Rise, Apple’s Dip, and Regional Shifts

The global wearables market continues to show resilience and growth, with 136.5 million units shipped in Q2 2025, marking a 9.6% year-over-year increase from Q2 2024. While some categories and regions are approaching maturity, others are fueling the next wave of expansion.

The wearables landscape remains heavily skewed toward basic earwear, which accounted for 84.9 million units—over 60% of total shipments. Smartwatches, both basic and advanced, collectively contributed 38.3 million units, with basic smartwatches slightly edging out advanced ones. Wrist bands held steady at 10.9 million units, while smart glasses and rings continued to gain traction, albeit from a smaller base.

China (PRC) continues to be the largest market, with nearly 50 million units shipped, thanks to strong local brand performance and consumer appetite for new form factors. Latin America posted the highest growth rate at 34.7%, driven by demand for budget-friendly devices. In contrast, APeJC saw a 5.7% decline, largely due to elevated inventory levels and a slowdown in India, which had previously been a growth engine.

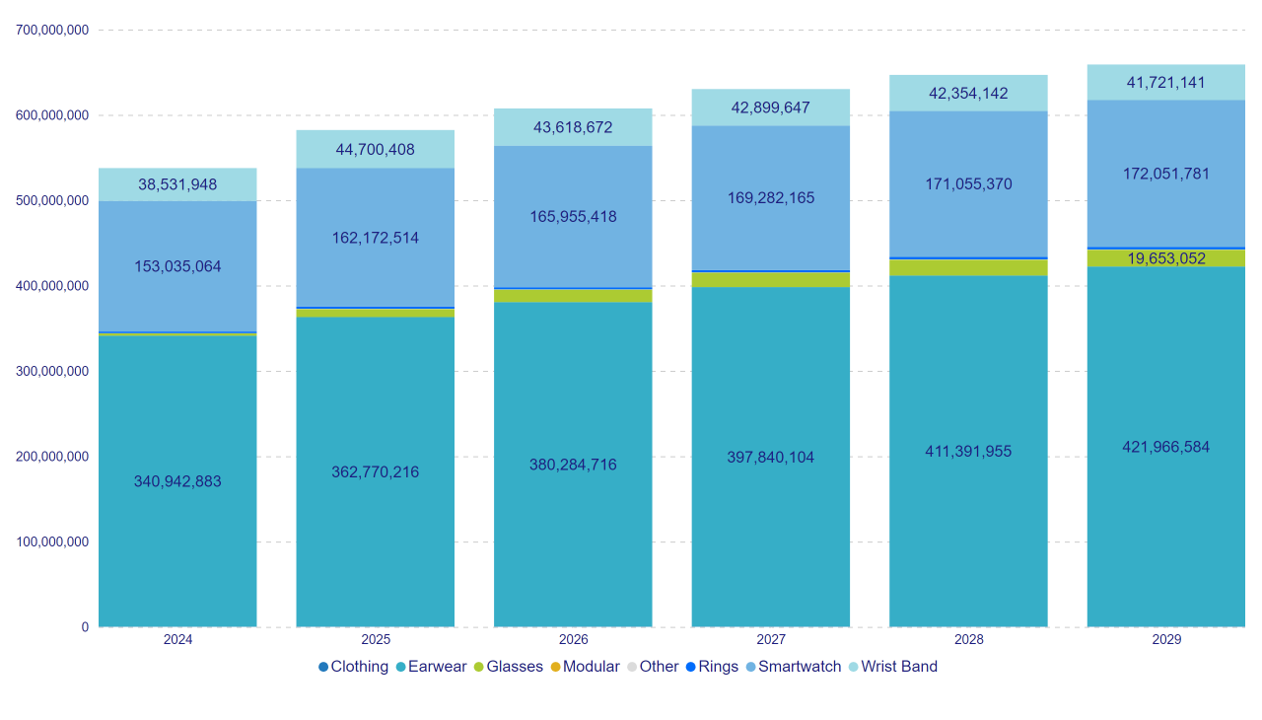

Worldwide Wearables Forecast by Product

| Year | Clothing | Earwear | Glasses | Modular | Other |

| 2025 | 352,064 | 362,770,216 | 9,421,015 | 1,922 | 324,397 |

| 2026 | 374,762 | 380,284,716 | 14,617,833 | 343,120 | |

| 2027 | 382,123 | 397,840,104 | 16,939,629 | 352,650 | |

| 2028 | 386,898 | 411,391,955 | 18,563,809 | 358,461 | |

| 2029 | 389,264 | 421,966,584 | 19,653,052 | 363,070 |

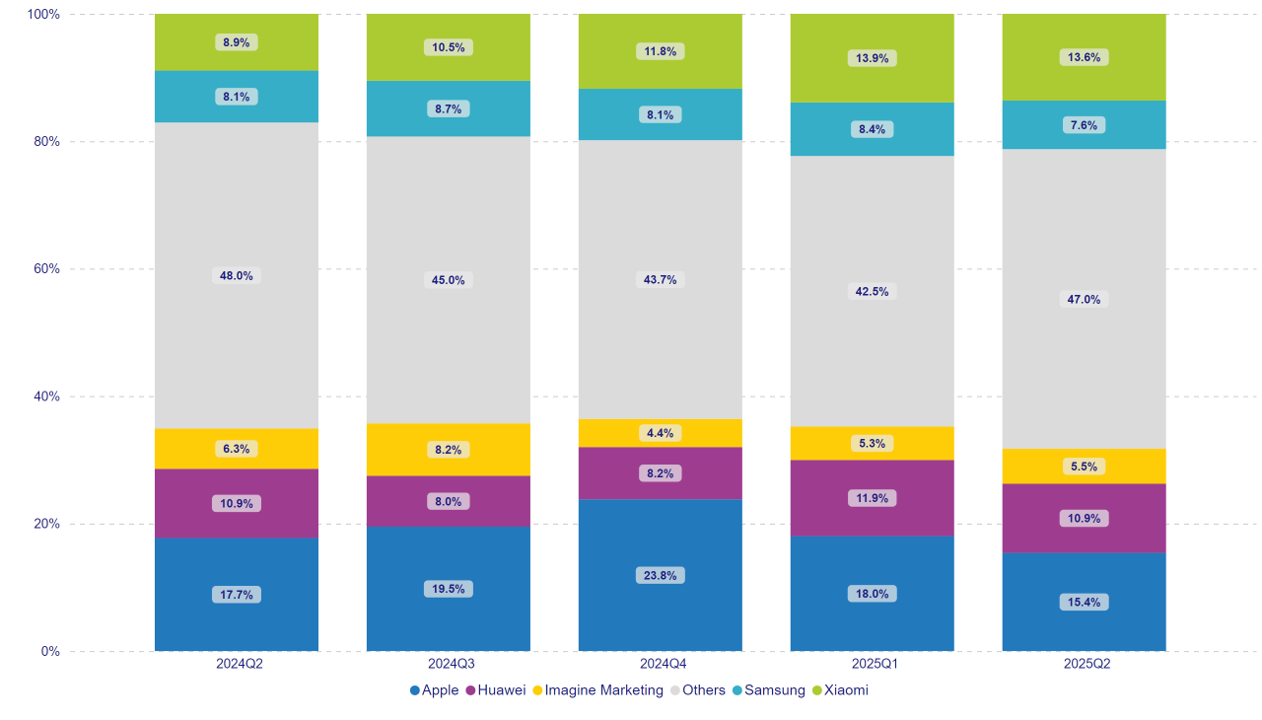

Top 5 Wearable Device Companies

| Quarter | Apple | Huawei | Imagine Marketing | Samsung | Xiaomi | Others |

| 2024Q2 | 22,104,609 | 13,526,073 | 7,864,775 | 10,151,990 | 11,100,588 | 59,844,749 |

| 2024Q3 | 28,912,843 | 11,829,947 | 12,190,343 | 12,955,944 | 15,570,307 | 66,684,590 |

| 2024Q4 | 35,994,642 | 12,404,966 | 6,673,865 | 12,206,715 | 17,778,880 | 66,122,339 |

| 2025Q1 | 23,749,583 | 15,722,870 | 6,926,532 | 11,064,570 | 18,324,641 | 55,905,942 |