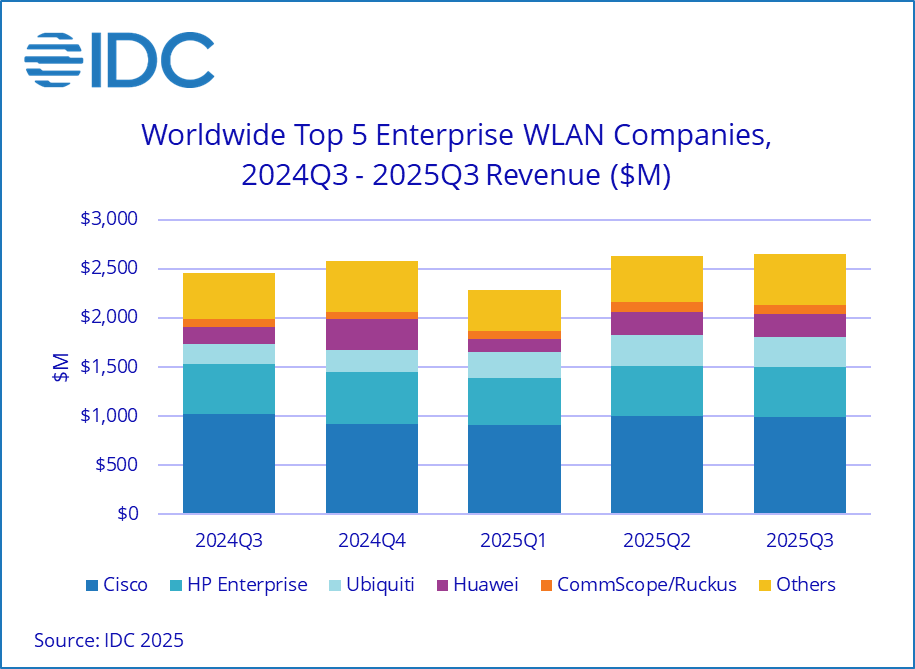

NEEDHAM, Mass., December 11, 2025 – The enterprise worldwide wireless local area network (WLAN) market grew 7.8% in the third quarter of 2025 (3Q25) compared to 3Q24 to reach $2.7 billion, building on the market’s growth momentum from the previous quarter, according to results published in the International Data Corporation (IDC) Worldwide Quarterly WLAN Tracker.

In the previous quarter, 2Q25, the market rose 13.2% YoY. Through the first three quarters of 2025, the market has risen 10.5% compared to the same period a year earlier. A significant driver of growth in the enterprise WLAN market is the adoption of new Wi-Fi standards. Wi-Fi 6E and Wi-Fi 7 enable up to a 3X increase in available bandwidth for Wi-Fi in the 6 GHz band, in certain geographies. Wi-Fi 7 made up 31.1% of market revenues in the dependent access point segment in 3Q25, compared to making up 21.0% of the segment’s revenues a quarter earlier. Meanwhile, Wi-Fi 6E made up 24.5% of the dependent AP segment’s revenue, with Wi-Fi 6 making up the balance.

From a geographical perspective, in the Americas, the enterprise WLAN market increased 6.0% year-over-year (YoY) in 3Q25. In the Europe, Middle East & Africa region, the market grew 12.8% YoY, and in the Asia Pacific region, revenues grew 5.6% YoY, with market revenues in the People’s Republic of China market revenues decreasing 1.3% YoY.

“Continued growth in the Enterprise WLAN market is driven by new standards like Wi-Fi 7 and Wi-Fi 6E, which enable a significant amount of new spectrum for Wi-Fi and expand the use cases for this important enterprise connectivity technology,” says Brandon Butler, senior research manager, Enterprise Networks, IDC. “IDC research shows that organizations are also increasingly prioritizing WLAN systems that integrate with the broader networking stack via platform-based approaches, have robust integrated security and ease the deployment and ongoing management of the Wi-Fi systems through the use of AI-powered networking capabilities.”

Below are results from notable enterprise WLAN vendors:

Cisco’s enterprise WLAN revenues declined 3.0% YoY in 3Q25 to $992.4 million, giving the company market share of 37.4% in the quarter.

HPE revenues grew 1.6% YoY in 3Q25 to reach $512.2 million, giving the company market share of 19.3%. Following the July 2025 acquisition HPE revenues now also include Juniper.

Ubiquiti enterprise WLAN revenues increased 47.1% YoY in 3Q25 to reach $300.3 million, giving the company market share of 11.3%.

Huawei enterprise WLAN revenues rose 33.7% YoY in 3Q25 to total $238.0 million, giving the company market share of 9.0%.

CommScope (Ruckus Networks) enterprise WLAN revenues increased 18.0% YoY in 3Q25 to total $93.3 million, giving the company market share of 3.5%.

The IDC Worldwide Quarterly WLAN Tracker provides total market size and vendors share data in an easy-to-use Excel Pivot Table format. The geographic coverage includes nine major regions (USA, Canada, Latin America, People’s Republic of China, Asia/Pacific excluding Japan & China, Japan, Western Europe, Central and Eastern Europe, and Middle East and Africa) and 60 countries. The WLAN market is further segmented by product class, product type, product, standard, and location. Measurement for the WLAN market is provided in vendor revenue, value, and unit shipments.

About IDC Trackers

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly excel deliverables and on-line query tools.

About IDC

International Data Corporation (IDC) is the premier global provider of trusted technology intelligence, advisory services, and events. With more than 1,000 analysts worldwide, IDC offers global, regional, and local expertise on technology, IT benchmarking and sourcing, and industry opportunities and trends in over 100 countries. IDC’s analysis and insights help IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. To learn more about IDC, please visit www.idc.com. Follow IDC on X at @IDC and LinkedIn. Subscribe to the IDC Blog for industry news and insights.