Worldwide Enterprise External OEM Storage Systems Market Spending showed a 4.5% growth in Q2 2025 and is expected to grow an average of 4.3% over a 5-year period, according to IDC

The external OEM enterprise storage systems (ESS) market reported annual growth of 4.3% in the second quarter of 2025, reaching $8.2 billion in spending. This was an improvement from the 3.1% growth in the first quarter. From the historical perspective, this level of growth is solid for the mature ESS market, but it still is undermined by the high double-digit growth in the server market, which is driven by investments in accelerated server infrastructure. Nevertheless, demand for flash storage (typically, all-flash arrays) to support projects related to artificial intelligence, both for training and inferencing, is increasing. The global and local economies remain one of the major concerns for IT infrastructure buyers.

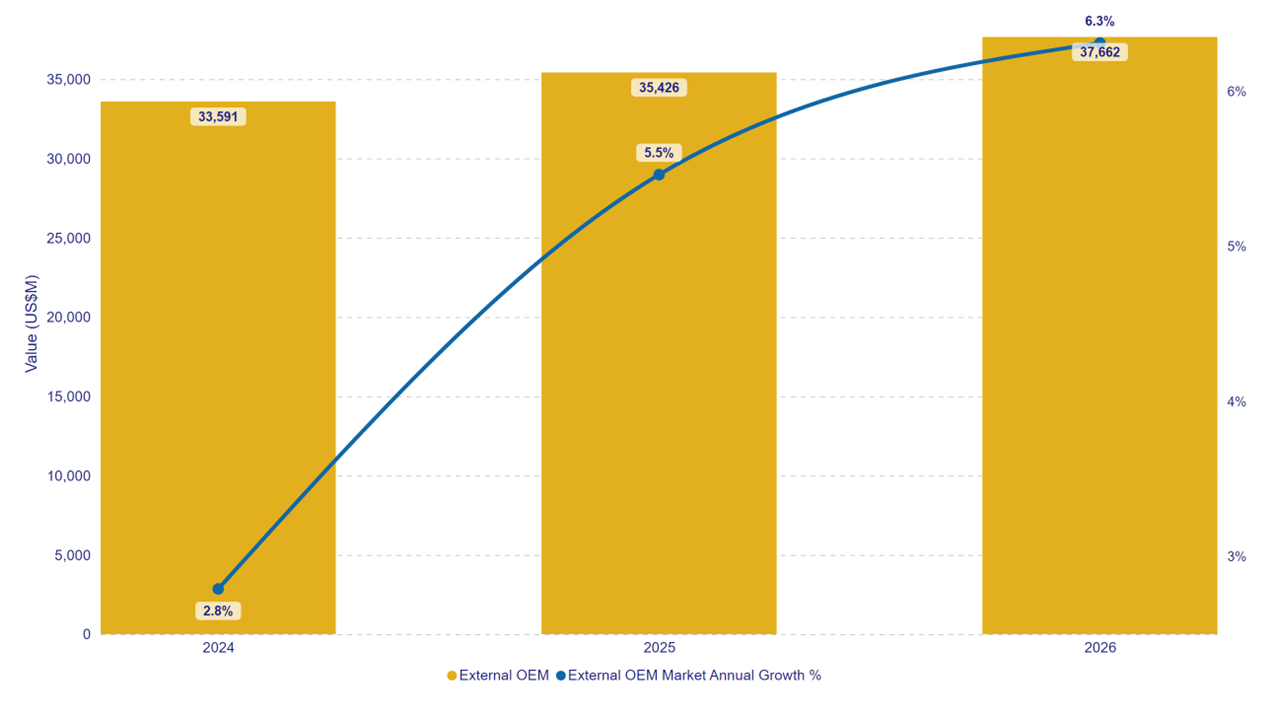

Respondents to the IDC Future Enterprise Resiliency & Spending Survey indicated growing expectations of the recession. While, so far, they are ready to increase budgets and spending on IT to promote greater use of AI. IDC expects the recovery of the external ESS market in 2025 to reach 5.5% compared to 2024 and will extend further into 2026 to 6.3% over 2025. We are witnessing the first big AI projects that involves External Storage Infrastructure in areas like Research and Education and there are more large projects to come that will help to keep the market up next year.

Worldwide ESS External OEM Market Forecast 2024 – 2026 Value (US$M)

| Data – Year | External OEM | External OEM Market Annual Growth % |

| 2024 | $33,591 | 2.8% |

| 2025 | $35,426 | 5.5% |

| 2026 | $37,662 | 6.3% |