Identify new markets and stay ahead of the competition

Identify new opportunities

You are looking to expand your company reach. Identify new potential markets and product needs. IDC’s proprietary data and insights give you the information you need to recognize new opportunities for business growth.

Stay ahead of industry trends

Be the first to know shifts in the industry to satisfy your customers’ needs and stay ahead of the competition. IDC’s predictive analysis gives you insight into the future of technology, trends in customer behavior, and technological advancements to give you the competitive edge you need.

Build a channel strategy

One way to expand your business is by developing relationships with key partners. IDC can help you identify the right partners and channels, and work with you to develop a strategy for expansion.

IDC Emerging Vendor solutions for expanding tech vendors

Designed for established tech companies looking to expand into new markets and channels, IDC’s Emerging Vendor Solutions offer the flexibility to build a partnership with IDC that meets the strategic goals of your company.

IDC’s Emerging Vendor Solutions offer:

- Unparalleled access to IDC’s gold-standard data and research to shape your market positioning and identify expansion opportunities

- Consultations with any of IDC’s 1300+ market experts to gain insights into local, national, and international market intelligence

- Expertise in channel/partner strategies and market forecasts to develop strategic plans to expand into new markets

- Dedicated Customer Support to help you navigate your IDC Experience

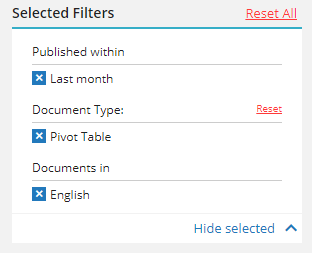

– A locked icon indicates you do not have access to that item (or you are not logged in)

– A locked icon indicates you do not have access to that item (or you are not logged in) – If the document as an attachment, paperclip icon will be displayed

– If the document as an attachment, paperclip icon will be displayed – If you are logged in, you can add this particular document into your bookcase by clicking on this icon

– If you are logged in, you can add this particular document into your bookcase by clicking on this icon – Clicking on this button will redirect you to the particular research and allows you to read it.

– Clicking on this button will redirect you to the particular research and allows you to read it. – This button takes to the detail of data products or events

– This button takes to the detail of data products or events